Watching Netflix? Listening to a Book? Creating a Doc? Vermont Taxes All of It

In Vermont, digital services are subject to the 6% state sales tax. Numerous municipalities across the state added a 1% local option tax, bringing the total tax rate in those communities to 7%.

As you settle in to stream the latest season of your favorite show, listen to a new audiobook on your commute, or even use cloud-based software for work, a portion of your subscription fee is heading to state coffers. Many Vermonters may not realize that a wide array of digital services and products are subject to the state's sales tax, a policy that quietly adds to the cost of our increasingly online lives.

Canada Rescinds Digital Service Tax

This taxation of the digital realm is a growing trend, but it is far from universal and not without controversy. While Vermont has forged ahead, our northern neighbor, Canada, recently made headlines by reversing course. In a significant move at the end of June 2025, the Canadian government announced it was rescinding its planned Digital Services Tax (DST). The tax, which would have primarily affected large American tech companies, was dropped to advance broader trade negotiations with the United States, highlighting the contentious nature of taxing the digital economy.

Even California Taxes Less

The practice of taxing digital goods and services is a patchwork across the United States. While a majority of states with a sales tax have moved to include at least some digital products in their tax base, a significant number have not. States like California, one of the epicenters of the tech industry, do not apply a general sales tax to digital downloads or streaming services. This divergence in policy underscores the ongoing debate about how to apply tax laws originally designed for a world of tangible goods to the intangible products of the 21st century.

In Vermont, these services are generally subject to the 6% state sales tax. Additionally, numerous municipalities across the state have adopted a 1% local option tax, bringing the total tax rate in those communities to 7%.

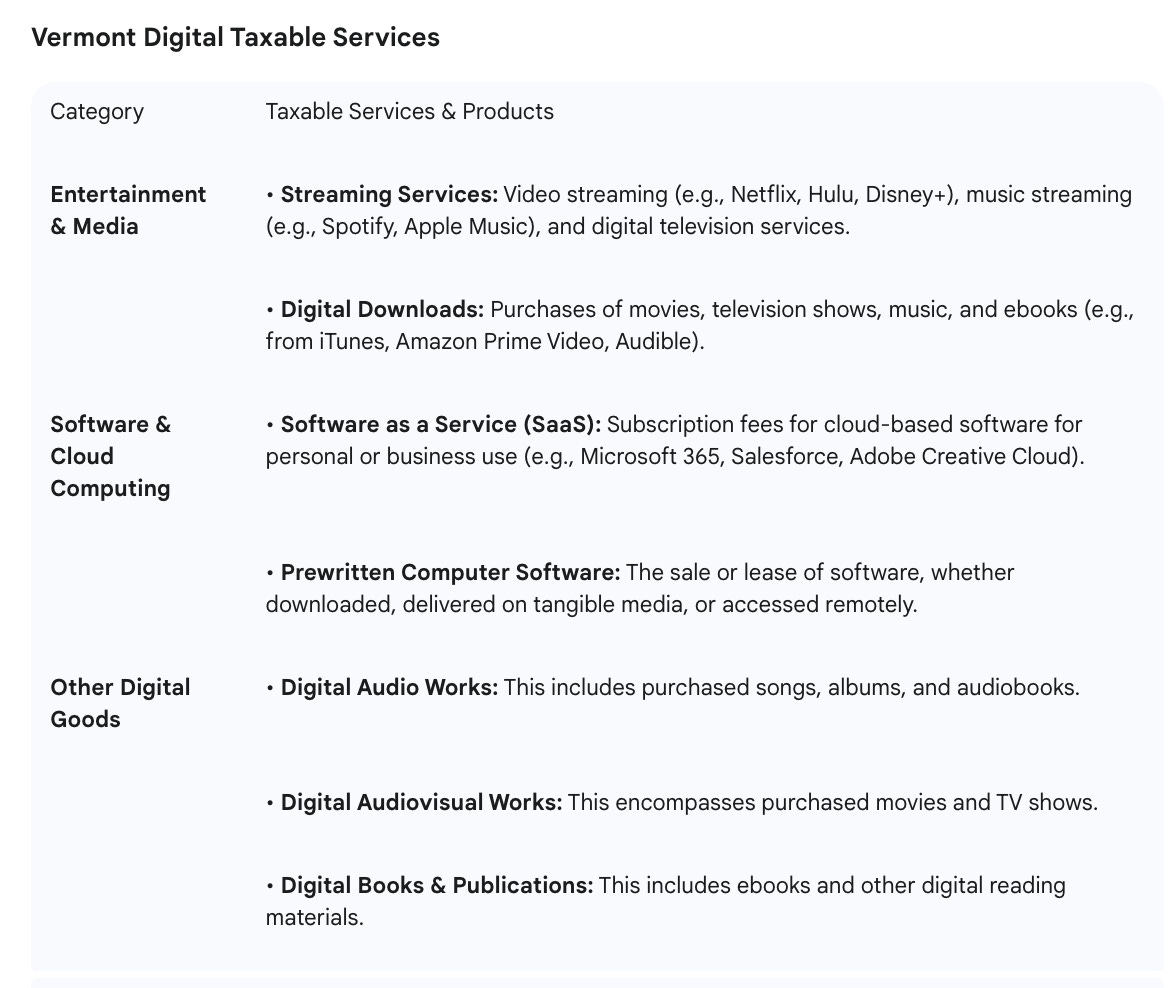

So, what exactly in your digital life is being taxed? The Vermont Department of Taxes provides guidance on what it calls "specified digital products" and "prewritten computer software," which are taxable regardless of how they are accessed. The table below outlines the services that are subject to Vermont's sales tax.