Vermont’s Plan to Bring Lottery Sales to Your Smartphone Relies on Michigan’s Success—But Pennsylvania Tells a Different Story

Two states, two outcomes, and a different model in New Hampshire shape the debate

Vermont lawmakers considering House Bill 669 face a fundamental question: Will allowing residents to buy lottery tickets and digital scratch-off games on their smartphones generate the revenue windfall the state needs, or will it lead to market saturation and declining sales?

The answer depends largely on which neighboring state you look at.

Michigan launched online lottery sales in 2014 and watched both digital and retail sales soar for seven years. Online lottery revenue grew to over $2 billion while retail sales grew at 7.8% annually and retail commissions doubled. It’s the success story cited by every proponent.

But Pennsylvania tells a different tale. After years of growth following its 2018 launch, Pennsylvania’s lottery profits dropped by over $130 million in fiscal year 2024-2025. Both retail scratch-off sales and online lottery sales declined simultaneously—retail by 6.2% and online by 14.8%. When economic pressures hit, Pennsylvania’s players cut back everywhere.

Vermont’s proposal, introduced in January 2026, would authorize the Department of Liquor and Lottery to sell tickets, digital “eInstants,” and lottery subscriptions through mobile apps and websites. The administration projects this could generate an additional $7 million for the Education Fund. But the divergent experiences highlight the risk of relying on Michigan’s success while overlooking Pennsylvania’s warning signs.

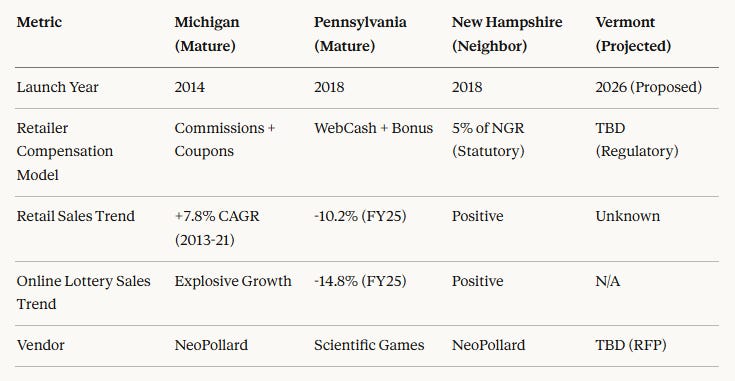

How Vermont’s Neighbors Compare

State Online Lottery Performance Comparison

New Hampshire’s position is particularly relevant. New Hampshire legalized online lottery with a critical difference: it wrote retailer protections directly into law, guaranteeing that 5% of net gaming revenue from online sales goes to brick-and-mortar stores. New Hampshire currently attracts some Vermont players, making Vermont’s proposal partly defensive.

The Fiscal Pressure Behind the Push

In his 2026 State of the State address, Governor Phil Scott emphasized the “obligation to follow through on education transformation” and the need for “affordability” for Vermont taxpayers, noting that students in affluent districts have access to significantly more course options than rural areas.

The administration’s FY2026 budget totals $9.0 billion, but much of that increase reflects inflation and payroll costs rather than new spending capacity. Meanwhile, sports betting has underperformed. Department of Liquor and Lottery Commissioner Wendy Knight testified in January that sports betting revenue for FY2025 would reach only $6.1 million, falling short of the initial $7 million target because Vermont bettors won more often than predicted.

Note: This online lottery proposal is separate from Governor Scott’s education plan for an optional school choice lottery for student enrollment—two different uses of the same word.

What the Bill Would Do

House Bill 669 grants the Board of Liquor and Lottery authority to establish rules for online lottery operations rather than creating detailed regulations in statute. This “enabling act” approach provides flexibility but means specifics—including retailer compensation—aren’t written into law.

The legislation requires all purchases be “initiated and received within the State” using geofencing technology, mandates age verification for players 18 and older, and exempts player personal, financial, and wagering information from Vermont’s Public Records Act.

The Economics: Where the Money Actually Goes

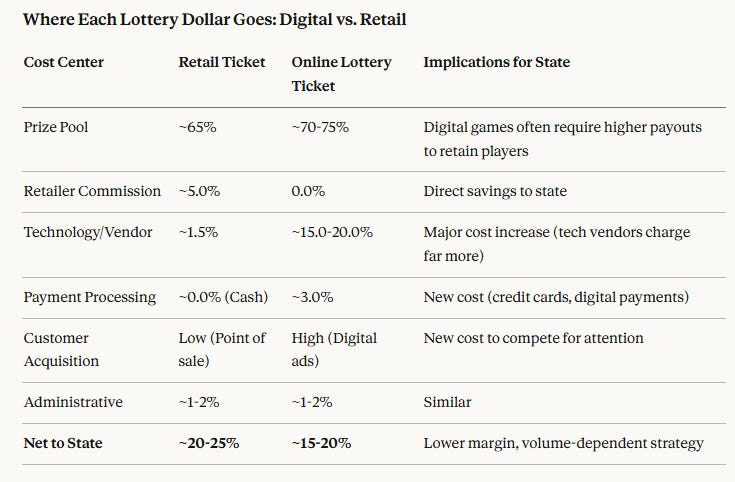

A common assumption is that online lottery helps the state by eliminating the 5-6% commission paid to stores. The reality is more complex:

The savings from eliminating retail commissions largely transfer to technology corporations and credit card processors. Digital lottery platforms require sophisticated vendors who typically charge 15-25% of net gaming revenue—far more than traditional systems. Payment processing adds 2-4%, and customer acquisition through digital advertising represents additional new costs.

The state’s margin on a digital lottery dollar can actually be thinner than on a retail dollar. The financial logic relies on volume, not margin—the belief that online players will wager more frequently, at all hours, capturing spending when people don’t want to drive to stores.

Why Pennsylvania’s Decline Matters

Pennsylvania’s simultaneous decline in both retail and online sales challenges a key assumption: that online lottery attracts a fundamentally different demographic who wouldn’t otherwise play. If online players were truly distinct—younger, tech-savvy people who never visit convenience stores—then online sales should remain resilient when retail declines.

Pennsylvania’s data suggests otherwise. When wallets tightened due to inflation and fewer billion-dollar Powerball jackpots, players reduced gambling everywhere. This indicates many online lottery players are the same people who buy tickets at stores, just using a different interface. When economic conditions worsen, they play less everywhere.

Michigan’s success occurred during a strong economic cycle from 2014 to 2021. Vermont’s smaller population, aging demographics, and current economic uncertainty make Pennsylvania’s recent experience potentially more predictive.

New Hampshire’s Built-in Protection for Retailers

The Vermont Retail & Grocers Association and convenience store owners worry about more than lost commissions. Research shows lottery customers typically purchase additional items during store visits. If customers buy Powerball tickets from their phones while pumping gas, they may skip entering the store entirely, costing retailers sales of coffee, snacks, and other items.

Commissioner Knight has stated the department intends to implement revenue-sharing for retailers, but this commitment doesn’t appear in H.669’s text. The bill delegates this authority to future rulemaking—contrasting sharply with New Hampshire’s statutory guarantee that 5% of net gaming revenue goes to brick-and-mortar retailers.

Pennsylvania uses an “affiliate” system where retailers sell funding vouchers earning commissions. Michigan sends digital coupons to online players redeemable only at physical stores. Vermont’s H.669 doesn’t mandate any specific retailer compensation structure.

The Social Cost Question

The most significant concern centers on “eInstants”—digital scratch-off games that can be played rapidly in succession with immediate results, unlike physical tickets with natural delays. These games often incorporate visual and auditory feedback similar to mobile video games or slot machines, and instant deposits from bank accounts remove the friction of handling cash.

Advocacy groups like Stop Predatory Gambling argue that moving lottery sales from public retail counters into private homes fundamentally alters the social contract around state-sponsored gambling. Vermont’s current investment in problem gambling services is below the national average, and H.669 lacks specific funding commitments for support services.

What Happens Next

House Bill 669 has been referred to the House Government Operations Committee, which received initial testimony in January 2026. Key questions include whether lawmakers will add statutory language guaranteeing retailer compensation, whether problem gambling funding should be written into law, and how to balance revenue needs against concerns about expanded gambling.

If passed, the Board of Liquor and Lottery would select a technology vendor and develop regulations before launching. The administration’s $7 million revenue target depends on attracting players without cannibalizing retail sales—a balance Michigan achieved during economic growth but Pennsylvania has struggled to maintain.

The debate centers on a choice shaped by two very different stories: Michigan’s explosive growth where everyone benefited, and Pennsylvania’s recent simultaneous decline across all channels. Vermont lawmakers must decide which story better predicts their state’s future—and whether the potential revenue justifies the risks of market saturation, retailer displacement, and expanded problem gambling in an uncertain economic climate.

Promote more Gambling??? Bad Idea....