Vermont's New Ed Bill Sets Tax Rates Based on Owners' Property Values; But What if You Rent?

If you rent, you won't be paying property taxes directly. However, the new law does have a significant impact on you through the newly-named Renter Credit program.

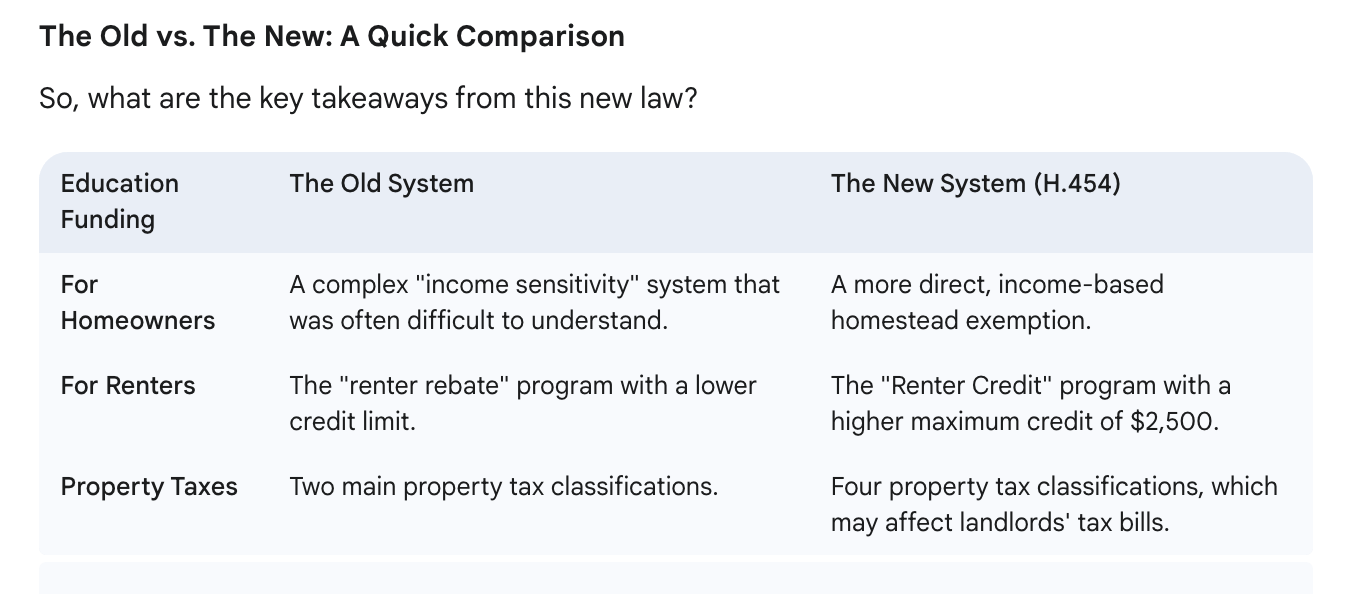

Vermont has just passed a landmark education funding bill, H.454, that overhauls how the state pays for its schools. The new law, which passed in the final days of the 2025 legislative session, is a major shift, moving to a system that sets property tax rates based on the value of residents' homes. But what does this mean for the nearly one-third of Vermonters who rent? Here’s a breakdown of what you need to know.

A New Formula for Homeowners

For homeowners, the new law introduces a "foundation formula" for education funding. This replaces the old, often confusing system with a more direct, income-based homestead exemption. The goal is to make property taxes more equitable, tying them more closely to a homeowner's ability to pay. The law also creates new regional assessment districts, which are intended to make property valuations more consistent across the state. This means that, for homeowners, their property tax bill will be a more direct reflection of their home's value and their income.

What Renters Need to Know: The Renter Credit

If you rent, you won't be paying property taxes directly. However, the new law does have a significant impact on you through the newly-named Renter Credit program, which replaces the old "renter rebate." Here’s how it works:

You can get money back: The Renter Credit program provides a direct payment to eligible renters to help offset the property taxes paid by their landlords.

The credit is bigger: H.454 increases the maximum credit to $2,500 per year.

How it's calculated: The credit is based on a portion of the fair market value of your rental unit, with the state considering 10% of this value as your contribution to property taxes.

Who is eligible: The credit is available to Vermont residents who meet certain household income requirements.

To get the credit, you will need to file a claim with the Vermont Department of Taxes, just as with the old renter rebate program.

The Indirect Impact: Your Landlord's Tax Bill

While the Renter Credit is a direct benefit, there is also an indirect way the new law could affect you. H.454 changes how properties are classified for tax purposes. Previously, there were two main classifications; now there are four. This means that non-homestead residential properties—which includes most rental units—may be taxed at a different rate.

Landlords who see their property taxes go up under this new system may pass that cost on to their tenants in the form of higher rent. So, while you won't get a property tax bill, you might see the impact in your monthly rent payment. The increased Renter Credit is intended to help soften the blow of any potential rent hikes.

In short, while the headlines may focus on property owners, Vermont's new education funding law has a significant impact on renters as well. The increased Renter Credit is a key provision to be aware of, but it's also important to understand how the changes to your landlord's taxes might affect your rent. As with any new law, the full impact will become clearer as it is implemented. For now, renters should keep an eye on their rental agreements and be sure to apply for the new, more generous Renter Credit.