Vermont's Medicare Advantage Market Has Collapsed. Here's What You Need to Know.

The collapse was caused by two forces colliding: the financial instability of Vermont’s largest insurer and a shifting national landscape that is making Medicare Advantage less profitable everywhere.

For more than 33,800 Vermont seniors, the healthcare landscape is about to change dramatically. In a move that effectively ends the individual Medicare Advantage (MA) market in the state, Blue Cross Blue Shield of Vermont and UnitedHealthcare are withdrawing nearly all their plans for 2026. This decision leaves thousands of Vermonters scrambling to understand their options and facing the prospect of significantly higher costs.

This isn’t just a corporate decision; it’s the result of a perfect storm of local financial crisis and national regulatory pressure.

What Is Happening to Medicare Advantage in Vermont?

The core issue is that the two main providers of individual Medicare Advantage plans are leaving the market.

Vermont Blue Advantage, an affiliate of Blue Cross Blue Shield of Vermont (BCBSVT), is completely withdrawing from the market. According to company statements, this will impact approximately 26,000 Vermonters.

UnitedHealthcare is also discontinuing its individual MA plans in 14 Vermont counties, affecting another 7,800 residents.

Together, these exits mean that as of 2026, the vast majority of the state will become a “coverage desert” for these plans. The only insurer left offering individual MA plans will be Humana, and its coverage is limited to just six counties: Bennington, Caledonia, Essex, Orange, Windham, and Windsor. According to Vermont’s Health Care Advocate, Mike Fisher, “Vermont’s Medicare Advantage marketplace has collapsed. There’s no insurance companies offering a statewide plan.”

It is important to note that this collapse primarily affects the individual market—plans that people buy for themselves. The market for employer-sponsored group plans, like the one for retired state teachers, remains functional, though it is also facing intense cost pressures. The state was able to negotiate a new contract for retired teachers with a carrier called HealthSpring after their previous insurer proposed a 50% premium increase.

Why Did This Happen? A Local Crisis Meets National Headwinds

The market collapse was caused by two powerful forces colliding: the severe financial instability of Vermont’s largest insurer and a shifting national landscape that is making Medicare Advantage less profitable everywhere, especially in rural states.

The Local Catalyst: A Financial Emergency

The decision by Blue Cross Blue Shield of Vermont was not a strategic choice but an act of financial survival. According to financial documents filed with the state, the insurer was in serious trouble, losing a staggering $152 million between 2021 and 2024. The losses were accelerating, culminating in a $62.1 million loss in 2024 alone.

These losses decimated the company’s financial reserves, which are legally required to ensure it can pay members’ claims. The insurer’s Risk-Based Capital (RBC) Ratio—a key measure of financial health—plummeted to 214%, far below the minimum range of 590% to 745% mandated by Vermont regulators. The money-losing Medicare Advantage division, which a company spokesperson said accounted for at least 20% of these losses, became an existential threat that had to be cut to prevent the entire organization from failing.

The National Squeeze: A Tougher Business

For years, Medicare Advantage was a “gold rush” for insurers. But that is changing due to two major federal policy shifts:

A Crackdown on “Upcoding”: The government pays MA plans more for sicker patients. This created an incentive for insurers to document as many health conditions as possible, a practice critics call “upcoding.” According to reports from the Kaiser Family Foundation and others, federal regulators are now using stricter audits to find and claw back improper payments, increasing financial risk for insurers.

New Prescription Drug Costs: The Inflation Reduction Act introduces a new $2,100 annual out-of-pocket cap on prescription drugs for seniors starting in 2026. While this is a huge benefit for consumers, it shifts billions of dollars in costs for high-price drugs directly onto the insurers.

These national pressures are being felt most acutely in rural states like Vermont. The MA business model relies on having a large population to spread risk and a dense network of doctors to control costs. With its low population, Vermont lacks the scale needed for the model to work efficiently, making it one of the first places to break under the new financial pressures.

What This Means for Your Wallet: The New Reality

For the 33,800 Vermonters losing their plans, the primary alternative is to switch to Traditional Medicare. While this provides excellent flexibility to see any doctor who accepts Medicare, it comes with a major catch: it has no out-of-pocket maximum. A serious illness could expose you to tens of thousands of dollars in medical bills from your 20% coinsurance.

To protect against this, most people on Traditional Medicare buy a Medicare Supplement (Medigap) plan. The good news is that everyone losing their MA plan has a “guaranteed issue” right to buy any Medigap plan without being denied or charged more for pre-existing conditions.

The bad news is the price. As Health Care Advocate Mike Fisher warned, Medigap plans in Vermont are “prohibitively expensive.”

Cost Comparison: A Potential Sticker Shock

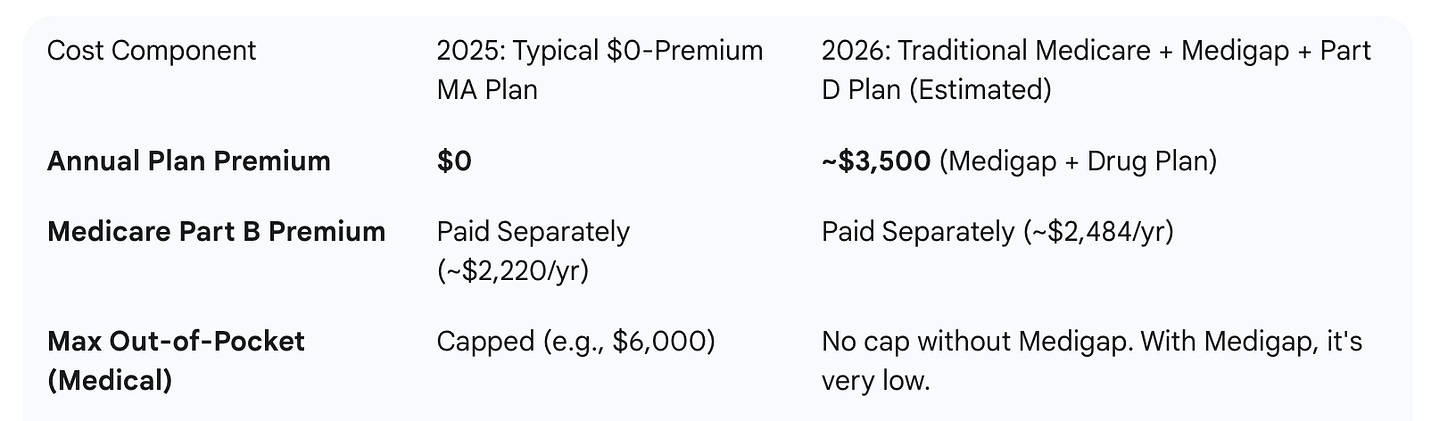

Let’s look at a typical scenario. Many Vermonters were enrolled in a $0-premium MA plan. Now, they face a much different cost structure.

As this estimate shows, a person seeking comprehensive coverage could see their annual premium costs more than double, increasing by over $3,700 per year. This affordability crisis is the central challenge facing Vermont seniors. Many may be forced to “go bare” and rely only on Traditional Medicare, exposing themselves to catastrophic financial risk.

A Guide for Vermonters: What to Do Next

Navigating this transition can feel overwhelming, but a clear plan can help.

Watch Your Mail: You will receive official notices about your plan ending. Do not throw these away. The letter from your insurer is the proof you need to use your guaranteed right to buy a Medigap plan.

Know Your Deadlines:

Oct. 15 – Dec. 7, 2025: This is the Annual Enrollment Period. You must sign up for a stand-alone Medicare Part D prescription drug plan during this time to have coverage on January 1.

Until March 4, 2026: This is your Special Enrollment Period to buy a Medigap plan with guaranteed issue rights.

Get Free, Unbiased Help: You do not have to figure this out alone. Vermont’s State Health Insurance Program (SHIP) offers free, one-on-one counseling. They are experts who can walk you through all your options based on your specific needs.

Make a Conscious Choice: You must decide whether to pay the high cost of a Medigap plan to protect yourself from unlimited medical bills or take the risk of going without one. Carefully consider your health, budget, and tolerance for risk.

The collapse of the Medicare Advantage market has created a difficult and expensive situation for thousands. By understanding the forces that caused it and the choices that lie ahead, Vermonters can navigate this new reality and find the best possible path forward for their healthcare coverage.

The cost comparison chart is misleading because it doesn't make clear how Medigap plans have low or no copays, unlike Medicare Advantage plans. This can save a lot of money. It means that especially for some people with high medical needs a Medigap plan can sometimes be a good choice, not just an expensive fallback.

It's very important to get help from an unbiased advisor like the Vermont SHIP Program (800-642-5119).