The Reserves Are Gone: December 1st Unveils the Real Cost of Vermont’s Education System

Decoding the warning of what the December 1 Tax Letter Means for Your Wallet and Vermont Schools

The release of the December 1, 2025, letter by the Vermont Department of Taxes signals the official start of the state’s education finance debate. Mandated by 32 V.S.A. § 5402b, this document forecasts the property tax yields and rates for Fiscal Year 2027. While usually a routine statutory update, this year’s letter arrives during a turbulent moment defined by rising structural costs and intense political disagreement over school governance.

An informed reading of the situation requires looking past the headlines to understand the specific mechanics driving the projected tax increases.

Separating the Math from the Message

For Vermont residents, legislators, and school board members, it is crucial to distinguish between the two distinct components of the December 1 letter: the statutory data and the executive narrative.

The statutory data—specifically the property dollar equivalent yield and the income dollar equivalent yield—are mathematical outputs. They represent a consensus forecast derived from economic data. The “yield” is essentially the purchasing power of your tax dollar; when the yield drops, the tax rate required to fund the same level of spending must go up.

The executive narrative, often found in the commentary surrounding these numbers, is a policy argument. The analysis of the 2025 letter suggests that while the arithmetic forecasting double-digit tax increases is accurate, the narrative framing may attribute these hikes to a lack of school consolidation. However, reports indicate that the primary cost drivers for Fiscal Year 2027 are immediate economic pressures rather than governance structures.

The Fiscal Cliff: When the Savings Run Out

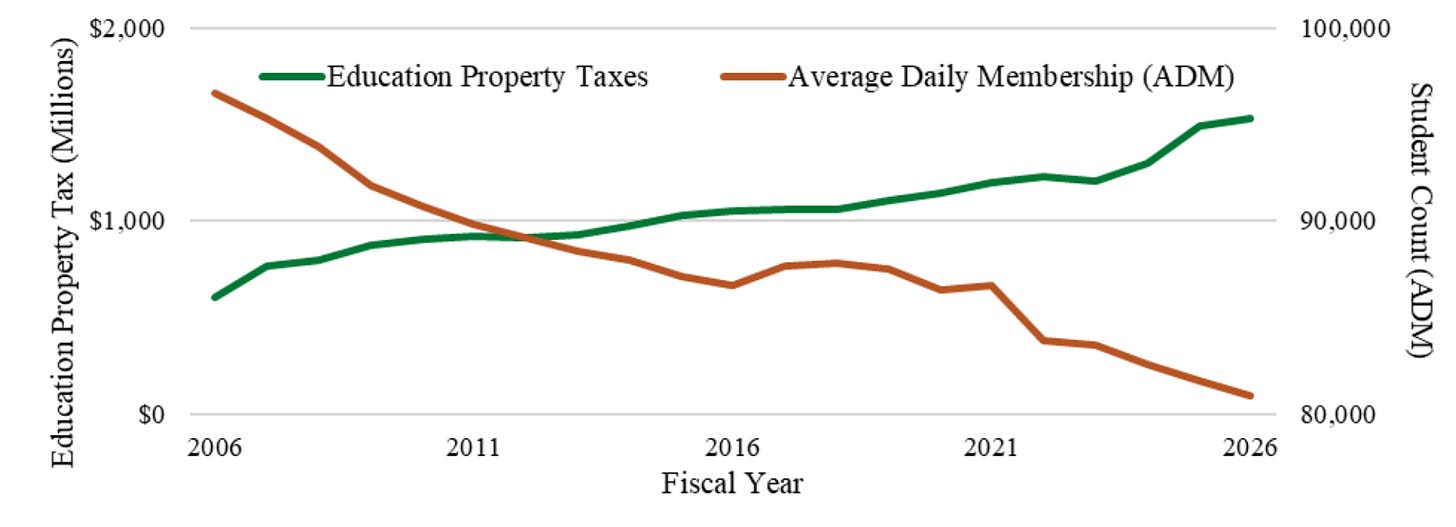

A major factor fueling the projected tax increase is the exhaustion of one-time funds. In previous years, the state utilized surpluses to “buy down” the tax rate, effectively shielding taxpayers from the true cost of education.

For example, looking back at the 2024 Education Tax Rate Letter, reserves were used to suppress rates. Now that those reserves are depleted, the system faces a “double whammy”: the tax rate must rise to cover actual spending plus the amount needed to replenish the statutory reserves. This creates a structural deficit before a single new dollar is spent on education.

Structural Cost Drivers: Healthcare and Special Education

While the political conversation often focuses on local school budgets, the analysis points to state-level mandates as the primary engines of cost growth.

Healthcare Costs: The transition to statewide bargaining has been accompanied by escalating premiums. Reports indicate that districts are facing significant increases in healthcare costs, a non-discretionary line item that local boards cannot control. Recent reviews of school budget contexts highlight this as a dominant fiscal pressure.

Special Education: Under Act 173, funding shifted to a census-based block grant. However, the rising acuity of student needs—requiring intensive interventions—has strained this model. Vermont’s special education system is facing challenges where the costs of high-needs services exceed the provided block grants, forcing local property taxes to cover the difference.

The Revenue Problem: The CLA Meltdown

Homeowners are likely to see the impact of the “Common Level of Appraisal” (CLA) on their tax bills. The CLA ensures equity between towns with different appraisal cycles. Following the post-COVID real estate boom, market values rose significantly while assessed values stayed flat, causing CLAs to plummet across the state.

As the Vermont League of Cities and Towns has explained, when the CLA drops, the tax rate mathematically increases to compensate. This “technical” adjustment is a major driver of the double-digit hikes forecast in the letter, independent of school spending decisions.

The Consolidation Controversy

The December 1 letter is inextricably linked to the debate over Act 73 of 2025, which mandated a task force to redesign school district maps. In November 2025, the School District Redistricting Task Force voted to reject mandatory consolidation maps, arguing there was a lack of evidence that forced mergers produce savings. Instead, they recommended a model of “Cooperative Education Service Areas.”

News reports confirm that the Task Force chose to preserve local governance while seeking efficiencies through shared services. The Department of Taxes may frame the projected tax hikes as a consequence of this “failure” to consolidate. However, fiscal analysis suggests that even if consolidation had been approved, the savings would not have materialized in time to offset the immediate costs impacting the Fiscal Year 2027 budget.

Equity and the “Cents Discount”

The tax landscape is further complicated by Act 127, the pupil weighting law designed to direct resources to high-need districts. To ease the transition, the legislature included a “cents discount” to cap rate increases for certain towns.

As Seven Days reported, this discount mechanism costs money, which is spread across the entire Education Fund. This means that part of the projected tax increase for FY2027 is serving to subsidize this transition mechanism.

What Happens Next

The publication of the December 1 letter serves as a warning, not a final invoice. It shifts the burden to the Vermont Legislature, which convenes in January.

The Yield Bill: Legislators must pass the annual “Yield Bill” to set the final tax rates. They will debate whether to find new revenue sources, use any remaining one-time money, or adjust the Act 127 transition mechanics.

Budget Votes: Local school boards are currently finalizing their budgets. Facing these headwinds, some districts may struggle to present budgets that voters will accept, potentially leading to delayed votes or revisions.

Governance Legislation: The Administration is expected to challenge the Task Force’s rejection of consolidation, potentially introducing legislation to mandate mergers despite the Task Force’s recommendation.

Residents should expect a contentious legislative session focused on balancing the immediate sticker shock of the Dec 1 projection with the complex realities of healthcare inflation, housing market shifts, and the desire for local control.

Little House on the Prairie and the 1 room schoolhouse no longer exists in Vermont. At Spauling in Barre I remember 3 girls from Cabot joined our Culinary Arts Class. The issue how are tax dollars being spent? Regarding SNAP a necessary program are only really eligible Vermonters receiving these benefits? If Vermont is a SANCTUARY STATE we shouldn't be. All people matter and those in the low economic strata must be taken care of. Are small business startups encouraged and enhanced? These are key issues.

It would be interesting to know, too, how much the addition of technology components in schools have added to the increase in their budgets - equipment, maintenance, professional training, technicians, curriculum advisors, and administration.