Sen. Welch Has A Long List of Amendments to National Tax Bill - Do They Have a Chance of Being Considered?

For Vermont, the legislation poses a direct challenge to several of its cornerstone state-run programs.

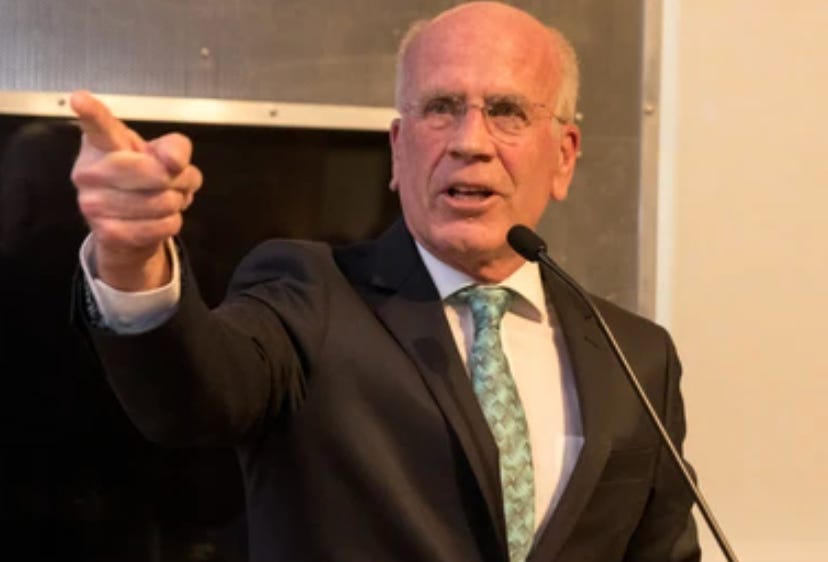

As a sweeping Republican-led budget bill, dubbed the "One Big Beautiful Bill Act" (OBBBA), advances to the U.S. Senate after a narrow House passage, Vermont's Senator Peter Welch is preparing for a legislative battle. The bill, which aims to make the 2017 Trump-era tax cuts permanent, is financed through significant changes to social programs and a rollback of recent green energy initiatives. In response, Senator Welch has unveiled a comprehensive suite of amendments designed to shield Vermont from what his office calls "disastrous" impacts.

The OBBBA, a massive reconciliation package, proposes to permanently lower individual and corporate tax rates, a move supporters argue is necessary to prevent a looming tax hike when the current provisions expire in 2025. However, these tax reductions are paid for by overhauling key pillars of the social safety net, including Medicaid and the Supplemental Nutrition Assistance Program (SNAP), and by repealing clean energy tax credits established under the Inflation Reduction Act.

For Vermont, the legislation poses a direct challenge to several of its cornerstone state-run programs. In a state with a high cost of living and an aging population, the proposed federal changes could have an outsized impact. Senator Welch's amendments seek to create a firewall around Vermont's unique systems, but the political reality of the Senate's budget reconciliation process suggests these efforts may be more about highlighting the bill's consequences and building alliances than achieving legislative victories.

Welch's Proposed Amendments: A Defensive Strategy

Senator Welch's proposed changes to the OBBBA are not aimed at broad national policy shifts, but rather at protecting specific Vermont programs from the bill's far-reaching effects. Here's a breakdown of his key amendments:

Protecting Vermont's Healthcare Model:

A central focus of Welch's amendments is to insulate Vermont's innovative healthcare system. The state's "Global Commitment to Health" Medicaid waiver and its All-Payer Accountable Care Organization (ACO) model, which aims to control costs and improve health outcomes, would be significantly impacted by the OBBBA's proposed cuts and structural changes to Medicaid.

Concrete Numbers: The OBBBA proposes deep cuts to federal Medicaid funding. While exact figures are subject to final legislative language and analysis, the user-provided research material estimates a potential $700 billion reduction nationally. For Vermont, where Medicare and Medicaid account for a majority of revenue for the state's 14 hospitals, such cuts could be devastating.

Welch's Proposal: The senator's amendments would seek to exempt states with approved Medicaid waivers like Vermont's from the new federal mandates. This would include holding Vermont harmless from funding reductions and protecting its ability to use provider taxes to help finance its share of Medicaid—a practice the OBBBA seeks to curtail.

Safeguarding Food Assistance:

The OBBBA also proposes fundamental changes to SNAP, known in Vermont as 3SquaresVT. For the first time, it would require states to share in the program's costs if their error rates exceed a certain threshold and would expand work requirements for older recipients.

Concrete Numbers: The bill proposes shifting costs to states with payment error rates above 6%. According to the most recent federal data, Vermont's error rate is a low 4.57%, well below this threshold. However, the bill also expands the work requirement age for Able-Bodied Adults Without Dependents from 54 to 64.

Welch's Proposal: Welch's amendments aim to strike the cost-shifting provision entirely. He also proposes to adjust the Thrifty Food Plan, which determines benefit amounts, for high-cost states like Vermont, where the average monthly grocery bill of $680 is significantly higher than the national average.

Preserving Energy Efficiency Incentives:

The OBBBA would repeal or limit many of the green energy tax credits from the Inflation Reduction Act, including those for homeowners who make energy-efficiency improvements.

Concrete Numbers: The federal Energy Efficient Home Improvement Credit currently provides up to $3,200 annually for upgrades like insulation and heat pumps.

Welch's Proposal: Senator Welch's amendments would strike the repeal of these credits. These federal incentives are often paired with state and utility programs, such as those offered by Efficiency Vermont, making energy-saving upgrades more affordable for Vermonters.

Do These Amendments Stand a Chance?

The short answer is: it's highly unlikely. The budget reconciliation process is a powerful tool that allows the majority party to pass budget-related legislation with a simple 51-vote majority, bypassing the usual 60-vote filibuster threshold. This process comes with strict rules, most notably the "Byrd Rule," which prohibits "extraneous" policy changes that are not primarily budgetary.

Any of Senator Welch's amendments could face a procedural challenge under the Byrd Rule. Even if they clear that hurdle, they would be subject to a "vote-a-rama," a marathon of rapid-fire votes on numerous amendments. During this process, the majority party typically remains unified to defeat amendments from the minority.

The primary function of these proposed amendments, therefore, is likely one of messaging. By forcing votes on these specific issues, Senator Welch can put every senator on the record. A vote against protecting rural hospitals or food assistance for seniors can become a powerful talking point in future campaigns, both in Vermont and in other states with similar concerns. These votes are designed to highlight the real-world consequences of the OBBBA and to build a coalition of opposition, even if they cannot alter the final text of the bill.

For Vermonters, the coming Senate debate will be a stark illustration of the clash between a "one-size-fits-all" federal policy and the state's long history of innovative, locally-tailored solutions. While Senator Welch's amendments face an uphill battle, they serve as a clear articulation of what is at stake for the Green Mountain State in this national legislative fight.