Mom-and-Pop Investors Keep Charging Ahead in Vermont's Housing Market—No Signs of a Slowdown in Sight

Inventory is rising and homes are taking longer to sell, but persistently low supply and strong lifestyle-driven demand mean prices are expected to continue their rise, albeit at a slower pace.

Vermont’s housing market has been fundamentally reshaped by a surge in real estate investment, with profound implications for residents. The core finding is that investors now own an estimated 31% of Vermont’s single-family homes, one of the highest rates in the nation. This figure includes a vast number of second homes and vacation properties.

Contrary to popular belief, these investors are not large corporations. The market is dominated by small-scale “mom-and-pop” landlords and out-of-state second-home buyers. This activity is directly linked to the state’s severe housing affordability crisis, as cash-rich buyers systematically outcompete local, first-time homebuyers.

The market in 2025 is in a period of “calibration”—a cooldown, not a crash. Inventory is rising and homes are taking longer to sell, but persistently low supply and strong lifestyle-driven demand mean prices are expected to continue their rise, albeit at a slower pace. In response, Vermont is pursuing a dual strategy: statewide deregulation to spur new construction and local re-regulation to control the impacts of short-term rentals (STRs). The tension between these approaches will define Vermont’s housing future.

National Trends, Local Realities

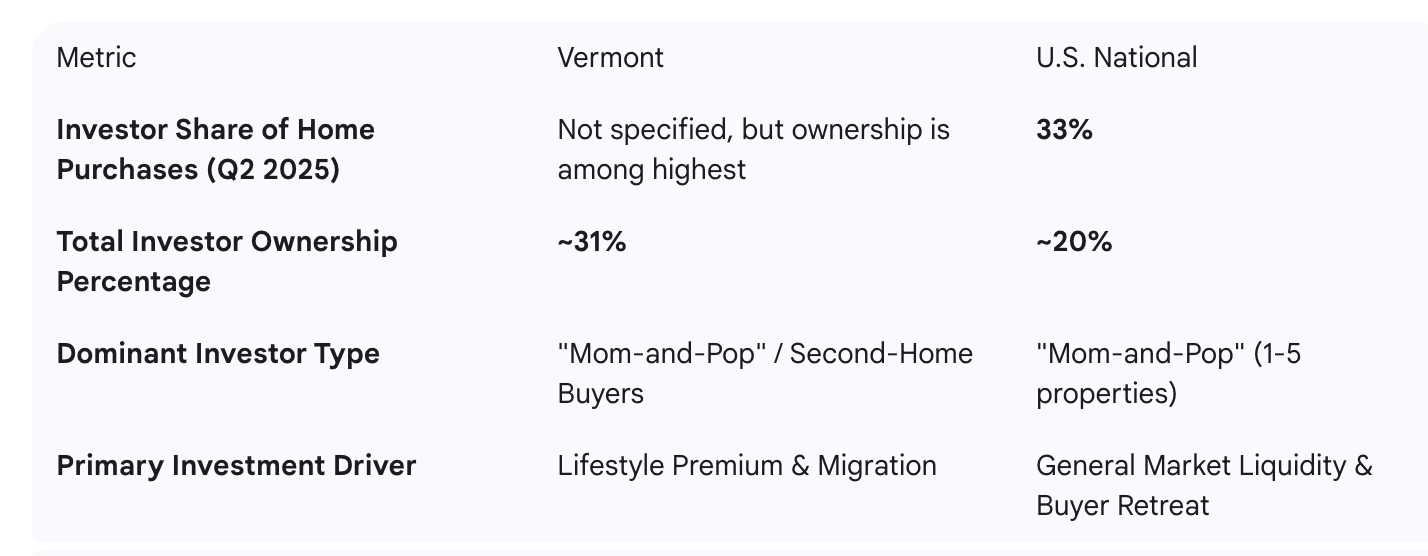

Nationally, investors purchased a record 33% of single-family homes in Q2 2025, according to a report from BatchData. This surge is less about a boom in investor demand and more about a retreat by traditional buyers priced out by high mortgage rates, as noted by Bankrate. The vast majority of these investors are “mom-and-pop” operations, with those owning 1-5 properties holding 87% of all investor-owned homes, according to BatchData.

Vermont is explicitly identified as a state with “higher-than-average” investor ownership, driven by migration. However, the driver here is more specific: a powerful “lifestyle premium,” according to Vermont Life Realtors. Buyers are drawn to the state’s brand of four-season recreation and quality of life. This, combined with an amplified “buyer retreat” due to the large gap between local wages and housing costs, creates a perfect opportunity for out-of-state, cash-rich buyers to gain a significant market share, pushing Vermont’s investor ownership rate to among the nation’s highest.

Of course. Here is a more concise version of the article that retains the key points and tables.

The Green Mountain State’s Housing Crossroads: Investor Activity and the Path Forward

Executive Summary: Vermont’s New Housing Reality

Vermont’s housing market has been fundamentally reshaped by a surge in real estate investment, with profound implications for residents. The core finding is that investors now own an estimated 31% of Vermont’s single-family homes, one of the highest rates in the nation. This figure includes a vast number of second homes and vacation properties.

Contrary to popular belief, these investors are not large corporations. The market is dominated by small-scale “mom-and-pop” landlords and out-of-state second-home buyers. This activity is directly linked to the state’s severe housing affordability crisis, as cash-rich buyers systematically outcompete local, first-time homebuyers.

The market in 2025 is in a period of “calibration”—a cooldown, not a crash. Inventory is rising and homes are taking longer to sell, but persistently low supply and strong lifestyle-driven demand mean prices are expected to continue their rise, albeit at a slower pace. In response, Vermont is pursuing a dual strategy: statewide deregulation to spur new construction and local re-regulation to control the impacts of short-term rentals (STRs). The tension between these approaches will define Vermont’s housing future.

National Trends, Local Realities

Nationally, investors purchased a record 33% of single-family homes in Q2 2025, according to a report from BatchData. This surge is less about a boom in investor demand and more about a retreat by traditional buyers priced out by high mortgage rates, as noted by Bankrate. The vast majority of these investors are “mom-and-pop” operations, with those owning 1-5 properties holding 87% of all investor-owned homes, according to BatchData.

Vermont is explicitly identified as a state with “higher-than-average” investor ownership, driven by migration. However, the driver here is more specific: a powerful “lifestyle premium,” according to Vermont Life Realtors. Buyers are drawn to the state’s brand of four-season recreation and quality of life. This, combined with an amplified “buyer retreat” due to the large gap between local wages and housing costs, creates a perfect opportunity for out-of-state, cash-rich buyers to gain a significant market share, pushing Vermont’s investor ownership rate to among the nation’s highest.

MetricVermontU.S. NationalInvestor Share of Home Purchases (Q2 2025)Not specified, but ownership is among highest33%Total Investor Ownership Percentage~31%~20%Dominant Investor Type“Mom-and-Pop” / Second-Home Buyers”Mom-and-Pop” (1-5 properties)Primary Investment DriverLifestyle Premium & MigrationGeneral Market Liquidity & Buyer Retreat

Export to Sheets

The Scale and History of Investor Ownership

The 31% investor ownership figure includes any home not used as a primary residence, which is crucial as it captures the large second-home market. This helps explain the “Primary Resident Homeownership” paradox: while Vermont’s official homeownership rate is a high 74.3%, according to Federal Reserve data, a more realistic rate for year-round residents is closer to 69% once non-primary residences are accounted for.

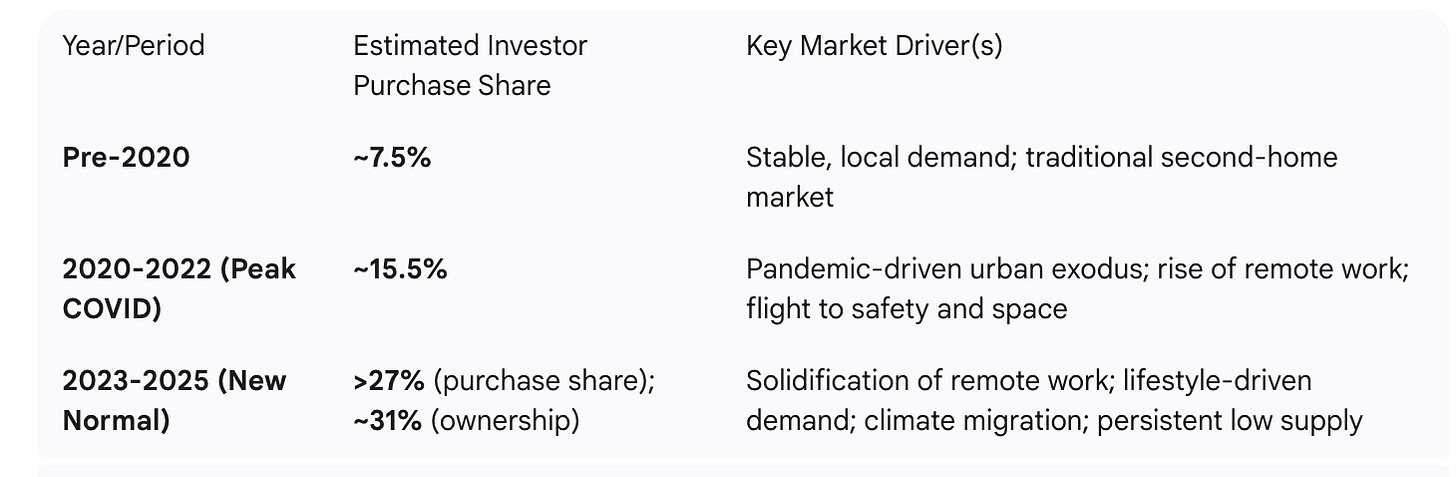

This situation is a recent development. Before the pandemic, the investor purchase share was a modest 7.5%, according to a Reddit analysis. During the 2020-2022 remote work boom, it doubled to 15.5% and has continued to accelerate since, establishing a new, much higher baseline and embedding affordability challenges into the market’s structure.

Of course. Here is a more concise version of the article that retains the key points and tables.

The Green Mountain State’s Housing Crossroads: Investor Activity and the Path Forward

Executive Summary: Vermont’s New Housing Reality

Vermont’s housing market has been fundamentally reshaped by a surge in real estate investment, with profound implications for residents. The core finding is that investors now own an estimated 31% of Vermont’s single-family homes, one of the highest rates in the nation. This figure includes a vast number of second homes and vacation properties.

Contrary to popular belief, these investors are not large corporations. The market is dominated by small-scale “mom-and-pop” landlords and out-of-state second-home buyers. This activity is directly linked to the state’s severe housing affordability crisis, as cash-rich buyers systematically outcompete local, first-time homebuyers.

The market in 2025 is in a period of “calibration”—a cooldown, not a crash. Inventory is rising and homes are taking longer to sell, but persistently low supply and strong lifestyle-driven demand mean prices are expected to continue their rise, albeit at a slower pace. In response, Vermont is pursuing a dual strategy: statewide deregulation to spur new construction and local re-regulation to control the impacts of short-term rentals (STRs). The tension between these approaches will define Vermont’s housing future.

National Trends, Local Realities

Nationally, investors purchased a record 33% of single-family homes in Q2 2025, according to a report from BatchData. This surge is less about a boom in investor demand and more about a retreat by traditional buyers priced out by high mortgage rates, as noted by Bankrate. The vast majority of these investors are “mom-and-pop” operations, with those owning 1-5 properties holding 87% of all investor-owned homes, according to BatchData.

Vermont is explicitly identified as a state with “higher-than-average” investor ownership, driven by migration. However, the driver here is more specific: a powerful “lifestyle premium,” according to Vermont Life Realtors. Buyers are drawn to the state’s brand of four-season recreation and quality of life. This, combined with an amplified “buyer retreat” due to the large gap between local wages and housing costs, creates a perfect opportunity for out-of-state, cash-rich buyers to gain a significant market share, pushing Vermont’s investor ownership rate to among the nation’s highest.

MetricVermontU.S. NationalInvestor Share of Home Purchases (Q2 2025)Not specified, but ownership is among highest33%Total Investor Ownership Percentage~31%~20%Dominant Investor Type“Mom-and-Pop” / Second-Home Buyers”Mom-and-Pop” (1-5 properties)Primary Investment DriverLifestyle Premium & MigrationGeneral Market Liquidity & Buyer Retreat

Export to Sheets

The Scale and History of Investor Ownership

The 31% investor ownership figure includes any home not used as a primary residence, which is crucial as it captures the large second-home market. This helps explain the “Primary Resident Homeownership” paradox: while Vermont’s official homeownership rate is a high 74.3%, according to Federal Reserve data, a more realistic rate for year-round residents is closer to 69% once non-primary residences are accounted for.

This situation is a recent development. Before the pandemic, the investor purchase share was a modest 7.5%, according to a Reddit analysis. During the 2020-2022 remote work boom, it doubled to 15.5% and has continued to accelerate since, establishing a new, much higher baseline and embedding affordability challenges into the market’s structure.

Year/PeriodEstimated Investor Purchase ShareKey Market Driver(s)Pre-2020~7.5%Stable, local demand; traditional second-home market2020-2022 (Peak COVID)~15.5%Pandemic-driven urban exodus; rise of remote work; flight to safety and space2023-2025 (New Normal)>27% (purchase share); ~31% (ownership)Solidification of remote work; lifestyle-driven demand; climate migration; persistent low supply

Export to Sheets

The Vermont Investor Profile: Beyond the Monolith

Vermont’s housing market is not being bought up by Wall Street. The primary actors are:

Small-Scale Landlords: Often local residents providing long-term rentals.

Second-Home/Lifestyle Buyers: Affluent, out-of-state buyers acquiring a “lifestyle asset,” removing homes from the year-round supply.

Short-Term Rental (STR) Operators: Commercially-oriented owners converting homes into tourist lodging, particularly in resort areas like Stowe and Killington.

Wholesalers/Rehabbers: A smaller group that buys, renovates, and either flips or rents distressed properties, often creating a closed investor-to-investor sales loop.

Notably absent are the large institutional hedge funds, as Vermont’s older, varied housing stock does not fit their standardized business model, according to BatchData. This means national policy debates targeting large investors often miss the mark for Vermont.

Of course. Here is a more concise version of the article that retains the key points and tables.

The Green Mountain State’s Housing Crossroads: Investor Activity and the Path Forward

Executive Summary: Vermont’s New Housing Reality

Vermont’s housing market has been fundamentally reshaped by a surge in real estate investment, with profound implications for residents. The core finding is that investors now own an estimated 31% of Vermont’s single-family homes, one of the highest rates in the nation. This figure includes a vast number of second homes and vacation properties.

Contrary to popular belief, these investors are not large corporations. The market is dominated by small-scale “mom-and-pop” landlords and out-of-state second-home buyers. This activity is directly linked to the state’s severe housing affordability crisis, as cash-rich buyers systematically outcompete local, first-time homebuyers.

The market in 2025 is in a period of “calibration”—a cooldown, not a crash. Inventory is rising and homes are taking longer to sell, but persistently low supply and strong lifestyle-driven demand mean prices are expected to continue their rise, albeit at a slower pace. In response, Vermont is pursuing a dual strategy: statewide deregulation to spur new construction and local re-regulation to control the impacts of short-term rentals (STRs). The tension between these approaches will define Vermont’s housing future.

National Trends, Local Realities

Nationally, investors purchased a record 33% of single-family homes in Q2 2025, according to a report from BatchData. This surge is less about a boom in investor demand and more about a retreat by traditional buyers priced out by high mortgage rates, as noted by Bankrate. The vast majority of these investors are “mom-and-pop” operations, with those owning 1-5 properties holding 87% of all investor-owned homes, according to BatchData.

Vermont is explicitly identified as a state with “higher-than-average” investor ownership, driven by migration. However, the driver here is more specific: a powerful “lifestyle premium,” according to Vermont Life Realtors. Buyers are drawn to the state’s brand of four-season recreation and quality of life. This, combined with an amplified “buyer retreat” due to the large gap between local wages and housing costs, creates a perfect opportunity for out-of-state, cash-rich buyers to gain a significant market share, pushing Vermont’s investor ownership rate to among the nation’s highest.

MetricVermontU.S. NationalInvestor Share of Home Purchases (Q2 2025)Not specified, but ownership is among highest33%Total Investor Ownership Percentage~31%~20%Dominant Investor Type“Mom-and-Pop” / Second-Home Buyers”Mom-and-Pop” (1-5 properties)Primary Investment DriverLifestyle Premium & MigrationGeneral Market Liquidity & Buyer Retreat

Export to Sheets

The Scale and History of Investor Ownership

The 31% investor ownership figure includes any home not used as a primary residence, which is crucial as it captures the large second-home market. This helps explain the “Primary Resident Homeownership” paradox: while Vermont’s official homeownership rate is a high 74.3%, according to Federal Reserve data, a more realistic rate for year-round residents is closer to 69% once non-primary residences are accounted for.

This situation is a recent development. Before the pandemic, the investor purchase share was a modest 7.5%, according to a Reddit analysis. During the 2020-2022 remote work boom, it doubled to 15.5% and has continued to accelerate since, establishing a new, much higher baseline and embedding affordability challenges into the market’s structure.

Year/PeriodEstimated Investor Purchase ShareKey Market Driver(s)Pre-2020~7.5%Stable, local demand; traditional second-home market2020-2022 (Peak COVID)~15.5%Pandemic-driven urban exodus; rise of remote work; flight to safety and space2023-2025 (New Normal)>27% (purchase share); ~31% (ownership)Solidification of remote work; lifestyle-driven demand; climate migration; persistent low supply

Export to Sheets

The Vermont Investor Profile: Beyond the Monolith

Vermont’s housing market is not being bought up by Wall Street. The primary actors are:

Small-Scale Landlords: Often local residents providing long-term rentals.

Second-Home/Lifestyle Buyers: Affluent, out-of-state buyers acquiring a “lifestyle asset,” removing homes from the year-round supply.

Short-Term Rental (STR) Operators: Commercially-oriented owners converting homes into tourist lodging, particularly in resort areas like Stowe and Killington.

Wholesalers/Rehabbers: A smaller group that buys, renovates, and either flips or rents distressed properties, often creating a closed investor-to-investor sales loop.

Notably absent are the large institutional hedge funds, as Vermont’s older, varied housing stock does not fit their standardized business model, according to BatchData. This means national policy debates targeting large investors often miss the mark for Vermont.

Investor TypePrimary MotivationGeographic FocusImpact on Housing MarketSmall LandlordLong-term rental income, retirementStatewide, concentrated in secondary cities (Montpelier, Barre, Rutland)Provides essential long-term rental stock; competes for smaller multi-family propertiesSecond-Home BuyerLifestyle, personal use, long-term appreciationTourist destinations (Stowe, Killington), Chittenden County, Mad River ValleyRemoves units from year-round housing supply; drives up prices with cash offersSTR OperatorMaximizing short-term rental revenuePrime tourist/ski areas (Stowe, Killington), areas with high visitor trafficConverts long-term rentals/primary homes to tourist use; inflates local pricesWholesaler/RehabberShort-term profit (flip), long-term rental (BRRRR)Statewide, wherever value-add opportunities existProvides market liquidity; can trap properties in an investor-to-investor cycle

Export to Sheets

Current Market Dynamics

The frenzied market of the pandemic has given way to a significant “calibration,” according to New England Landmark Realty. Inventory is up 17.5% year-over-year, and homes are taking longer to sell, with the median days on market rising to 49, according to Redfin. However, demand remains strong enough that sales volume is also up 11.0%, and the median sale price has still risen 5.8% to $434,200. The market now favors sellers less dramatically, allowing buyers more time for due diligence. Price trends have become hyper-local, with some towns seeing appreciation while neighboring ones see slight declines, making statewide averages less meaningful.

Of course. Here is a more concise version of the article that retains the key points and tables.

The Green Mountain State’s Housing Crossroads: Investor Activity and the Path Forward

Executive Summary: Vermont’s New Housing Reality

Vermont’s housing market has been fundamentally reshaped by a surge in real estate investment, with profound implications for residents. The core finding is that investors now own an estimated 31% of Vermont’s single-family homes, one of the highest rates in the nation. This figure includes a vast number of second homes and vacation properties.

Contrary to popular belief, these investors are not large corporations. The market is dominated by small-scale “mom-and-pop” landlords and out-of-state second-home buyers. This activity is directly linked to the state’s severe housing affordability crisis, as cash-rich buyers systematically outcompete local, first-time homebuyers.

The market in 2025 is in a period of “calibration”—a cooldown, not a crash. Inventory is rising and homes are taking longer to sell, but persistently low supply and strong lifestyle-driven demand mean prices are expected to continue their rise, albeit at a slower pace. In response, Vermont is pursuing a dual strategy: statewide deregulation to spur new construction and local re-regulation to control the impacts of short-term rentals (STRs). The tension between these approaches will define Vermont’s housing future.

National Trends, Local Realities

Nationally, investors purchased a record 33% of single-family homes in Q2 2025, according to a report from BatchData. This surge is less about a boom in investor demand and more about a retreat by traditional buyers priced out by high mortgage rates, as noted by Bankrate. The vast majority of these investors are “mom-and-pop” operations, with those owning 1-5 properties holding 87% of all investor-owned homes, according to BatchData.

Vermont is explicitly identified as a state with “higher-than-average” investor ownership, driven by migration. However, the driver here is more specific: a powerful “lifestyle premium,” according to Vermont Life Realtors. Buyers are drawn to the state’s brand of four-season recreation and quality of life. This, combined with an amplified “buyer retreat” due to the large gap between local wages and housing costs, creates a perfect opportunity for out-of-state, cash-rich buyers to gain a significant market share, pushing Vermont’s investor ownership rate to among the nation’s highest.

MetricVermontU.S. NationalInvestor Share of Home Purchases (Q2 2025)Not specified, but ownership is among highest33%Total Investor Ownership Percentage~31%~20%Dominant Investor Type“Mom-and-Pop” / Second-Home Buyers”Mom-and-Pop” (1-5 properties)Primary Investment DriverLifestyle Premium & MigrationGeneral Market Liquidity & Buyer Retreat

Export to Sheets

The Scale and History of Investor Ownership

The 31% investor ownership figure includes any home not used as a primary residence, which is crucial as it captures the large second-home market. This helps explain the “Primary Resident Homeownership” paradox: while Vermont’s official homeownership rate is a high 74.3%, according to Federal Reserve data, a more realistic rate for year-round residents is closer to 69% once non-primary residences are accounted for.

This situation is a recent development. Before the pandemic, the investor purchase share was a modest 7.5%, according to a Reddit analysis. During the 2020-2022 remote work boom, it doubled to 15.5% and has continued to accelerate since, establishing a new, much higher baseline and embedding affordability challenges into the market’s structure.

Year/PeriodEstimated Investor Purchase ShareKey Market Driver(s)Pre-2020~7.5%Stable, local demand; traditional second-home market2020-2022 (Peak COVID)~15.5%Pandemic-driven urban exodus; rise of remote work; flight to safety and space2023-2025 (New Normal)>27% (purchase share); ~31% (ownership)Solidification of remote work; lifestyle-driven demand; climate migration; persistent low supply

Export to Sheets

The Vermont Investor Profile: Beyond the Monolith

Vermont’s housing market is not being bought up by Wall Street. The primary actors are:

Small-Scale Landlords: Often local residents providing long-term rentals.

Second-Home/Lifestyle Buyers: Affluent, out-of-state buyers acquiring a “lifestyle asset,” removing homes from the year-round supply.

Short-Term Rental (STR) Operators: Commercially-oriented owners converting homes into tourist lodging, particularly in resort areas like Stowe and Killington.

Wholesalers/Rehabbers: A smaller group that buys, renovates, and either flips or rents distressed properties, often creating a closed investor-to-investor sales loop.

Notably absent are the large institutional hedge funds, as Vermont’s older, varied housing stock does not fit their standardized business model, according to BatchData. This means national policy debates targeting large investors often miss the mark for Vermont.

Investor TypePrimary MotivationGeographic FocusImpact on Housing MarketSmall LandlordLong-term rental income, retirementStatewide, concentrated in secondary cities (Montpelier, Barre, Rutland)Provides essential long-term rental stock; competes for smaller multi-family propertiesSecond-Home BuyerLifestyle, personal use, long-term appreciationTourist destinations (Stowe, Killington), Chittenden County, Mad River ValleyRemoves units from year-round housing supply; drives up prices with cash offersSTR OperatorMaximizing short-term rental revenuePrime tourist/ski areas (Stowe, Killington), areas with high visitor trafficConverts long-term rentals/primary homes to tourist use; inflates local pricesWholesaler/RehabberShort-term profit (flip), long-term rental (BRRRR)Statewide, wherever value-add opportunities existProvides market liquidity; can trap properties in an investor-to-investor cycle

Export to Sheets

Current Market Dynamics: A Cooldown, Not a Crash

The frenzied market of the pandemic has given way to a significant “calibration,” according to New England Landmark Realty. Inventory is up 17.5% year-over-year, and homes are taking longer to sell, with the median days on market rising to 49, according to Redfin. However, demand remains strong enough that sales volume is also up 11.0%, and the median sale price has still risen 5.8% to $434,200. The market now favors sellers less dramatically, allowing buyers more time for due diligence. Price trends have become hyper-local, with some towns seeing appreciation while neighboring ones see slight declines, making statewide averages less meaningful.

IndicatorAugust 2024 (or nearest)August 2025 (or nearest)Year-over-Year Change (%)Source(s)Median Sale Price~$410,400$434,200+5.8%Redfin# of Homes Sold735816+11.0%Redfin# of Homes for Sale (Inventory)3,4484,052+17.5%RedfinMedian Days on Market42 days49 days+16.7%Redfin

Export to Sheets

Geographic Hotspots and the “Tale of Two Vermonts”

Investor activity is concentrated in specific areas. Chittenden County remains the economic hub with the highest prices and strongest rental demand. Ski towns and tourist destinations like Stowe and the Mad River Valley are epicenters for second-home and STR investment, driven by a “lifestyle premium.” As prices in these areas become prohibitive, demand is spilling over into Central Vermont and secondary cities like Barre and Rutland. This creates a “Tale of Two Vermonts”: one of high-priced, amenity-rich areas facing intense investor competition, and another of more rural regions facing different challenges like economic stagnation.

The Affordability Crisis: The Human Cost

These market dynamics have a real-world impact. Over half of Vermont’s renter households are “severely cost-burdened,” spending over 50% of their income on housing, according to VHFA. The state needs an estimated 36,000 new homes by 2029 to meet demand, as stated in the 2025 Housing Needs Assessment.

At the heart of the crisis is the “Housing Wage” gap. According to the National Low Income Housing Coalition, a Vermonter must earn $29.73 per hour to afford a modest two-bedroom apartment, more than double the state’s minimum wage. This creates the “Equity Rich Paradox”: while existing homeowners have seen immense wealth growth, new buyers, particularly young families, are locked out, threatening the state’s future workforce.

The Regulatory Response: A Two-Pronged Approach

Vermont’s policy response is defined by a fundamental tension. At the state level, a push for deregulation aims to boost supply. The landmark HOME Act of 2023 eased local zoning restrictions to allow for denser housing, and a 2025 executive order from Governor Phil Scott seeks to fast-track permits and reduce fees.

Simultaneously, at the local level, a wave of re-regulation is underway. Municipalities like Winooski and Stowe are implementing strict licensing and zoning rules to control the conversion of homes into STRs. This creates a complex landscape where it may be easier to get a permit to build a duplex, but harder to use it as a short-term rental.

The Path Forward: Forecast and Strategic Outlook

Looking ahead, expect continued but more moderate price growth of 3-5% annually. A market crash is highly unlikely due to chronically low supply and durable, lifestyle-driven demand. The market is shifting from being liquidity-driven to fundamentals-driven, rewarding well-priced properties and demanding more diligence from buyers and investors.

Vermont’s housing market is increasingly resembling other amenity-rich, supply-constrained areas where real estate prices are permanently decoupled from local incomes.