If a Vermonter Wins the $1.7 Billion Powerball Jackpot, the State Wins Big Too

If a Vermonter wins and takes the lump sum, the state taxes the prize at 6%, sending an estimated $46 million straight to the General Fund.

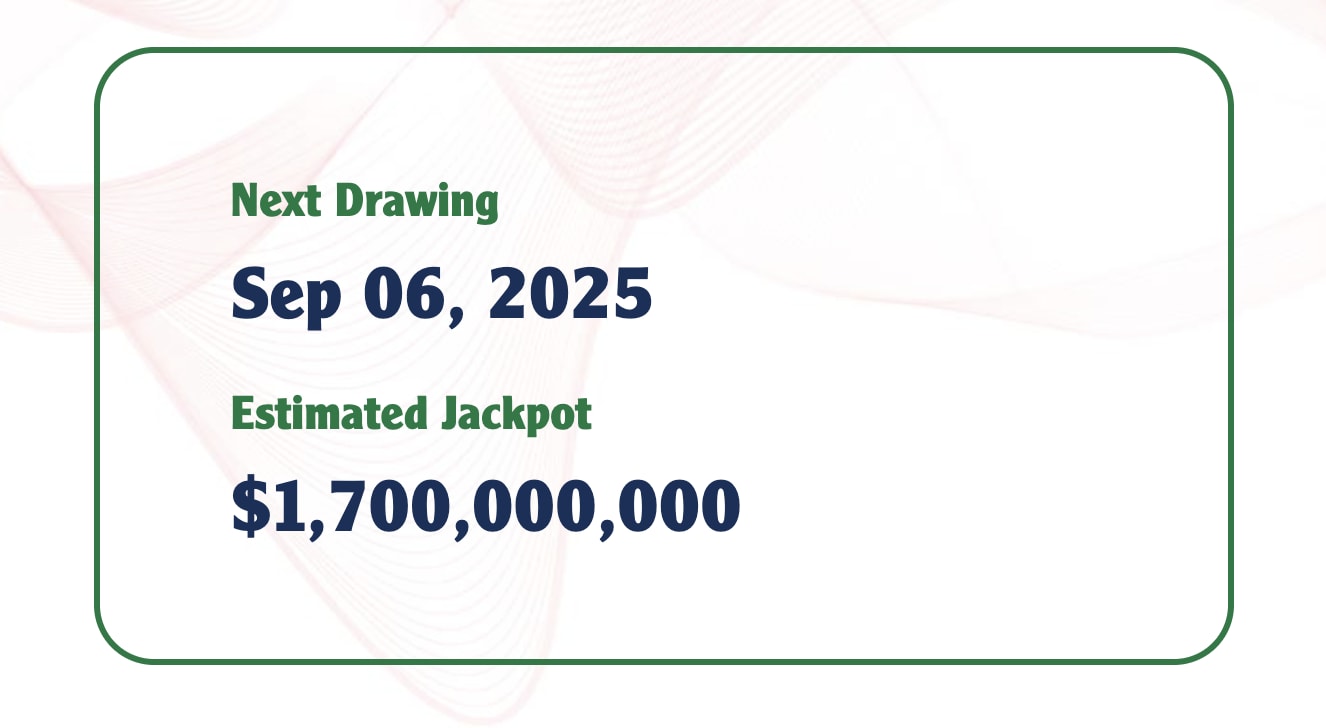

Saturday’s $1.7 billion Powerball jackpot is eye-popping by any measure. It’s the third-largest prize in U.S. lottery history, and Vermonters are joining millions across the country in snapping up tickets. But the excitement doesn’t stop with individual dreams of mansions and sports cars. If a Vermont resident were to claim the winning ticket, the state itself would cash in too.

The Immense Size of the Prize

The advertised jackpot stands at $1.7 billion if taken as an annuity paid out over three decades. Most winners, however, opt for the lump-sum cash option, which this time comes in at about $770 million before taxes.

That’s the kind of money that could turn a single household into a small economy. And because of Vermont’s tax structure, a winner here wouldn’t be celebrating alone—the state would immediately take its cut.

What Vermont Collects From a Winner

At a press conference this week, Liquor and Lottery Commissioner Wendy Knight explained the breakdown.

If a Vermonter wins and takes the lump sum, the state taxes the prize at 6%, sending an estimated $46 million straight to the General Fund.

That money is separate from the Education Fund, which is normally the destination for Vermont Lottery profits.

“People sometimes think a jackpot win goes to education,” Knight said. “But that 6% is different—it’s General Fund revenue.”

Ticket Sales Alone Pump Up Education

Even if no Vermonter wins, the state benefits every time someone buys a ticket. Vermonters spent $656,000 on Powerball tickets this Wednesday, compared with $226,000 the week before.

“That’s almost triple,” Knight noted. “And because there’s no associated increase in cost, that means it’s just extra money that goes to the Education Fund.”

The Education Fund pays for public schools across the state. When jackpots climb, the frenzy at convenience stores translates directly into more money for classrooms.

How Vermont Stacks Up

Other states also dedicate lottery proceeds to education, though the structures vary:

Virginia sends all profits to K–12 schools, generating nearly $934 million last year.

North Carolina directs 100% of net lottery proceeds to education, including scholarships and school construction.

Massachusetts spreads lottery revenue more broadly to local aid, not just schools.

Vermont’s model is somewhere in between: ongoing ticket sales support schools, but the one-time jackpot tax flows into the General Fund.

What $46 Million Could Do in Vermont

To put that potential windfall in perspective: Vermont spends about $27,000 per K–12 student each year, one of the highest rates in the nation. With about 83,500 students, annual statewide spending totals more than $2.2 billion.

An extra $46 million wouldn’t change the system overnight, but it could fund:

Roughly 1,300 new teachers, if applied to salaries and benefits.

Major upgrades to aging school buildings.

Technology initiatives or expanded after-school programs.

Even a single jackpot win could ripple out in visible ways if lawmakers chose to steer the money toward education or other priorities.

Vermont Dreams, Vermont Dollars

So while most Vermonters buying a ticket this week will walk away with nothing more than a few hours of daydreaming, the state is already a winner. Ticket sales have soared, fattening the Education Fund. And if lightning strikes and a Vermont resident claims the jackpot, the state treasury will suddenly be tens of millions richer.

The odds of winning remain astronomical—1 in 292 million—but the impact for both an individual and for Vermont’s budget is crystal clear. In this lottery, it isn’t just the players who stand to win.