Here's an Idea: Leverage Vermont’s Captive Insurance Industry to Stabilize Education Taxes

By treating the education sector as an owner of risk rather than a renter of insurance, Vermont has an opportunity to utilize its own local industry expertise to stabilize the Education Fund and taxes

Vermont’s education finance system is facing a convergence of escalating healthcare costs and complex funding formulas, creating an environment where property tax increases are projected to approach 12%. While the current insurance framework, administered through the Vermont Education Health Initiative (VEHI), has historically consolidated risk, it now faces pressure from inflation and structural rigidities.

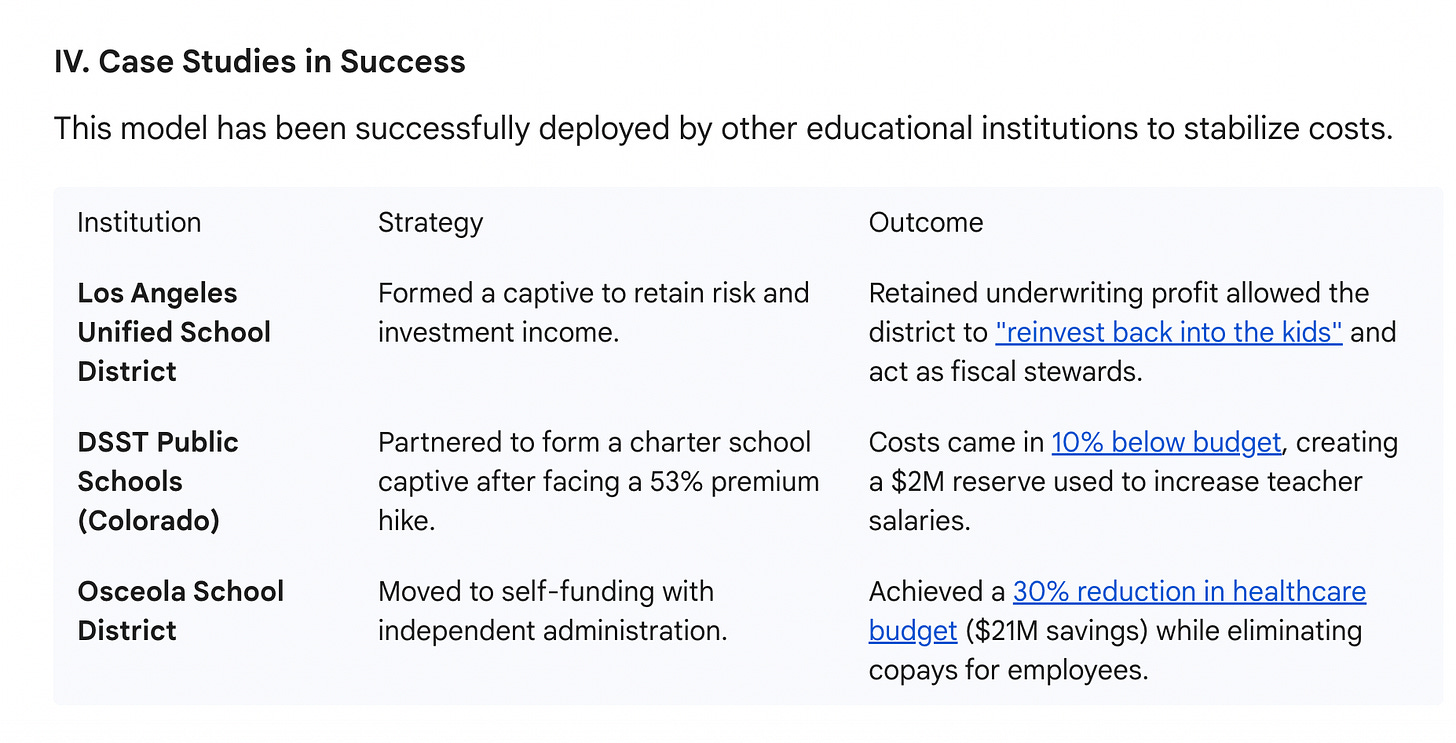

This report explores a transition to a Hybrid Captive Insurance Model. By utilizing Vermont’s status as the world’s premier captive domicile, the education sector could potentially unbundle insurance costs, repatriate underwriting profits, and maximize investment income. This is not merely an administrative change, but a shift from treating healthcare as a sunk cost to managing it as a financial portfolio.

I. The Fiscal Imperative: Understanding the Cost Drivers

To understand the solution, one must first understand how health costs impact Vermont property taxes. Unlike states where local taxes are determined solely by local property values, Vermont operates a statewide system where the “Yield” determines the tax rate.

The Leverage of Health Spending

The formula for a district’s tax rate creates a direct relationship between spending and taxes. Because health insurance is often the second-largest line item in school budgets, premium hikes exercise a leveraged effect on the tax rate.

District Tax Rate=Education Spending per PupilProperty Yield×$1.00

When health premiums rise globally, the “spending” numerator rises for nearly every district. This forces the Legislature to either lower the Yield—driving up tax rates for every homeowner—or inject one-time money from the General Fund.

The “Three Cliffs” of Taxpayer Burden

The burden of these increases falls unevenly due to income sensitivity “cliffs.”

The Circuit Breaker Cliff: Caps on income sensitivity have not kept pace with inflation, pushing more low-income Vermonters over the threshold.

The Middle-Income Cliff: Households earning just above sensitivity thresholds face the full weight of rate increases.

The Budgetary Feedback Loop: Rising premiums consume the “growth capacity” of school budgets, often forcing boards to choose between cutting educational programming or spiking tax rates.

II. The Proposed Solution: A Hybrid Captive Model

Currently, VEHI operates as a non-profit trust.1 While efficient, it acts largely as a “pass-through” entity—collecting premiums and paying claims. If claims exceed premiums, net positions decrease, necessitating future rate hikes.

A Captive Insurance Company is a subsidiary formed to insure the risks of its owners.2 The goal shifts from extracting profit to minimizing the total cost of risk.

The Protected Cell Structure (PCC)

The proposed model utilizes a Protected Cell Company structure, which offers a “best of both worlds” approach:

The Core: A central entity that holds the license, manages compliance, and purchases reinsurance for catastrophic claims.

The Cells: Individual Supervisory Unions or regions occupy their own “cells.” Assets and liabilities in each cell are legally segregated.

This structure addresses the “free rider” problem. If a district in a specific cell manages its risk well and reduces claims, the savings stay in that cell, allowing them to lower their specific district tax rate or reinvest in education.

III. Strategic Advantages

Transitioning to a captive model offers specific financial and operational levers that are unavailable or underutilized in the current system.

1. Investment Income Arbitrage

Insurance carriers generate profit by investing premiums before claims are paid—known as the “float.”3 currently, VEHI’s investment authority is restricted. A captive, regulated under Title 8 Chapter 141, can invest in marketable securities and corporate bonds.

The Impact: On a portfolio of hundreds of millions, even a 1% increase in yield can generate millions in non-tax revenue to subsidize premiums.

2. Unbundling the Cost Stack

Commercial insurance bundles administration, risk, and profit. A captive “unbundles” these costs.

Stop-Loss Efficiency: Instead of paying retail rates for stop-loss coverage (insurance for high claims), a captive can access the global reinsurance market directly.

Profit Recapture: If claims are lower than expected, the underwriting profit stays with the schools rather than a commercial carrier.

3. Data Transparency and Supply Chain Management

Captives own their data, allowing for granular analysis of cost drivers.4 This enables:

PBM Carve-Outs: Schools can contract directly with Pharmacy Benefit Managers (PBMs) to ensure 100% of rebates are passed back to the plan, significantly reducing prescription drug costs.

Direct Contracting: The captive can negotiate rates directly with Centers of Excellence for high-cost procedures.

V. Risk Assessment

No financial model is without risk. A balanced view requires analyzing potential downsides.

Volatility: Small districts in a single cell could face a “bad year” of claims.

Mitigation: The “Core” provides a risk-sharing layer, and the captive purchases aggregate stop-loss insurance to cap maximum liability.

Capital Calls: If premiums are priced too low, the captive may require additional funds.

Mitigation: Conservative underwriting is essential. Premiums should initially mirror commercial rates to build surplus, with savings realized through dividends after solvency is secured.

Complexity: Managing an insurance company requires strict regulatory adherence.

Mitigation: Vermont is home to the world’s leading captive management firms, allowing schools to outsource regulatory compliance to experts.

What Happens Next

To move from concept to implementation, the following steps would be required:

Feasibility Study: An actuarial analysis of five years of VEHI claims data to determine attachment points and capital requirements.

Stakeholder Alignment: Engagement with VSBIT, VT-NEA, and the Department of Financial Regulation to ensure the model funds benefits efficiently without reducing them.

Legislative Action: Potential authorization for a one-time loan or bond to capitalize the captive, which would be repaid through future premium savings.

Licensing: Application to the Vermont DFR for a Sponsored Captive license.

By treating the education sector as an owner of risk rather than a renter of insurance, Vermont has the opportunity to utilize its own local industry expertise to stabilize the Education Fund and property tax rates.

When a local school district's Superintendent makes 200k a yr. and they ask for more Money, let alone all the other ad-min salaries, what's wrong with that picture???

Brilliant breakdown of the Protected Cell structure here. The idea of unbundling adminstration, risk, and profit lets districts actually see where the money goes instead of just paying whatever the carrier decides. One thing that'd be intresting is whether other small states with tight-knit education systems could replicate this or if Vermont's captive expertise is the real unlockfor making this work.