AI Energy Boom vs. State Sovereignty: New Rules Could Sideline Vermont's Renewable Mandates

The federal directive creates a loophole. If a massive data center connects to the grid under federal rules, it may not be required to follow Vermont’s Renewable Energy Standard.

For decades, the regulation of electricity in the United States has relied on a balance known as “cooperative federalism.” The federal government manages the big interstate transmission lines, while states like Vermont regulate local utilities, set rates, and decide where power plants are built.

This system allows Vermont to enforce its own environmental priorities, such as the Global Warming Solutions Act and land use laws.

However, a new directive from the Department of Energy (DOE) threatens to upend this balance. Issued by Energy Secretary Chris Wright, the directive orders the Federal Energy Regulatory Commission (FERC) to rapidly accelerate the connection of massive energy users to the grid. This move, designed to support the booming Artificial Intelligence (AI) sector, reclassifies large data centers in a way that could bypass Vermont’s Public Utility Commission (PUC). For Vermont residents, this technical rule change could have profound impacts on local control, electricity rates, and the state’s ability to meet its climate goals.

The “Wright Directive”: A New Federal Fast Lane

The core of the new federal plan revolves around “large load” interconnections. Historically, when a factory or data center wanted to plug into the grid, it was treated as a retail customer subject to state oversight. The new directive argues that because modern data centers are so large, they should be treated as transmission customers under federal jurisdiction.

The DOE has set the threshold for this federal control at 20 Megawatts (MW). While this might seem small on a national scale, in Vermont, it is significant. A single 20 MW facility represents roughly 2% of the state’s entire peak demand. By shifting jurisdiction to FERC, the federal government aims to create a streamlined path for these facilities, potentially bypassing state requirements for environmental review or renewable energy usage.

The Push for AI Dominance

The urgency behind this directive is driven by a national focus on “energy dominance” and the race for supremacy in Artificial Intelligence. The administration has framed state-level regulations not as protections, but as a “patchwork” that thwarts innovation.

This policy push creates a unique situation where energy regulation intersects with high-stakes business interests. For example, the directive coincides with the merger of Trump Media & Technology Group with TAE Technologies, a fusion energy company. Because the new rules facilitate “co-location”—placing data centers directly next to power plants—they create a favorable regulatory environment for fusion and other generation technologies to power AI directly, bypassing traditional grid fees.

The Collision with Vermont’s Climate Laws

Vermont has some of the most stringent climate laws in the country, specifically the Global Warming Solutions Act (GWSA) and the Renewable Energy Standard (RES). The GWSA mandates legally binding emissions reductions, allowing citizens to sue the state government if targets are missed.

The conflict arises because the federal directive creates a loophole. If a massive data center connects to the grid under federal rules, it may not be required to follow Vermont’s Renewable Energy Standard. If that data center draws power from natural gas plants rather than renewables, Vermont’s total emissions would rise. This could leave the state in a legal bind: sued by the federal government if it tries to block the facility, and sued by its own citizens for failing to meet climate targets.

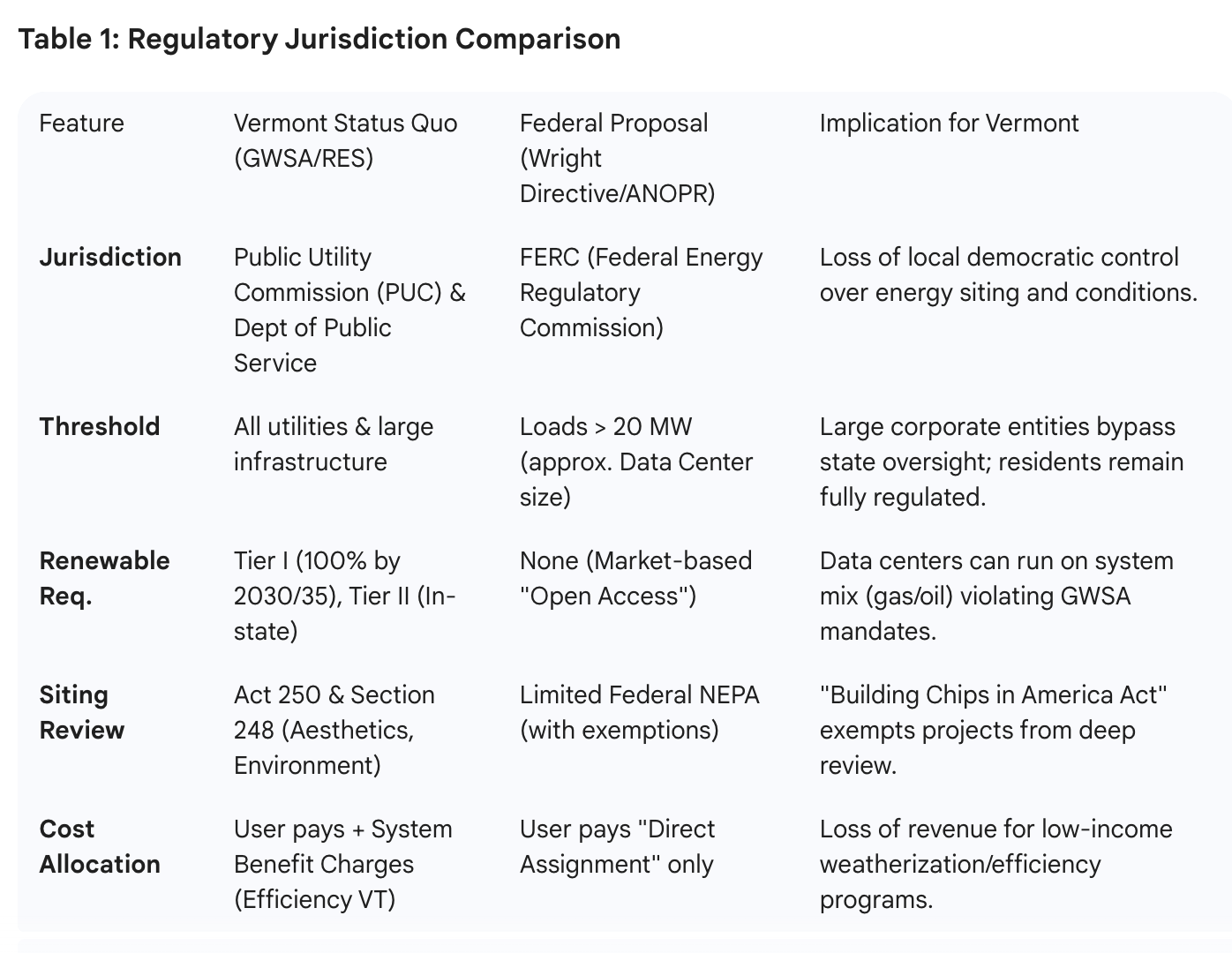

Understanding the Regulatory Shift

To see how the landscape shifts under this proposal, Table 1 compares the current Vermont status quo with the proposed federal rules.

The Risk of “Co-Location” and Ratepayer Costs

One of the specific mechanisms promoted by the DOE is “co-location,” where a data center sits directly next to a power plant (like a nuclear or gas station) and takes power “behind the meter”.

While this ensures the data center gets steady power, it raises questions about fairness. If a large user stops paying for the upkeep of the regional transmission grid, the remaining costs must be spread among the other customers—Vermont families and small businesses. Furthermore, if a data center requires massive grid upgrades and then closes down (a risk known as “stranded assets”), ratepayers could be left footing the bill for the unused infrastructure.

A Tale of Two Approaches: GlobalFoundries vs. The Future

The practical impact of this shift is best understood by looking at GlobalFoundries (GF). In 2022, GF negotiated with the Vermont PUC to become its own utility. The state agreed, but only on the condition that GF remain subject to the Renewable Energy Standard. It was a compromise that balanced industrial needs with state policy.

Under the Wright Directive, a similar facility arriving in 2026 could bypass the PUC entirely. It would apply directly to ISO New England (the grid operator) under federal rules. Vermont would lose the leverage to negotiate renewable requirements or community benefits, potentially resulting in a facility that uses non-renewable power while contributing nothing to state efficiency programs.

What Happens Next

The timeline for this regulatory overhaul is aggressive. The DOE has directed FERC to finalize these rules by April 30, 2026.

In the intervening months, three major developments are expected:

Litigation: Vermont, likely alongside other New England states, is expected to sue the federal government, arguing that the Federal Power Act explicitly protects state authority over retail customers.

Counter-Litigation: The Department of Justice has been directed to form a task force to challenge state laws that obstruct AI development, creating a potential legal showdown over the GWSA.

Regional Friction: Within New England, states may be divided. While Vermont fights for its climate laws, states with nuclear plants (like Connecticut and New Hampshire) might welcome the “co-location” rules as a financial lifeline for their aging facilities.

Residents should expect to see this debate play out in courtrooms and legislative hearings throughout early 2026 as the state grapples with the tension between federal mandates and local sovereignty.

Much ado about nothing.

No company would open an AI data center in Vermont. We are not business friendly, not on the internet backbone. Not located in an energy dense and fertile regulatory environment. Our grid is maximixed already. In short we don't have any of the required basic infrastructure attributes to support the modern economy and jobs.