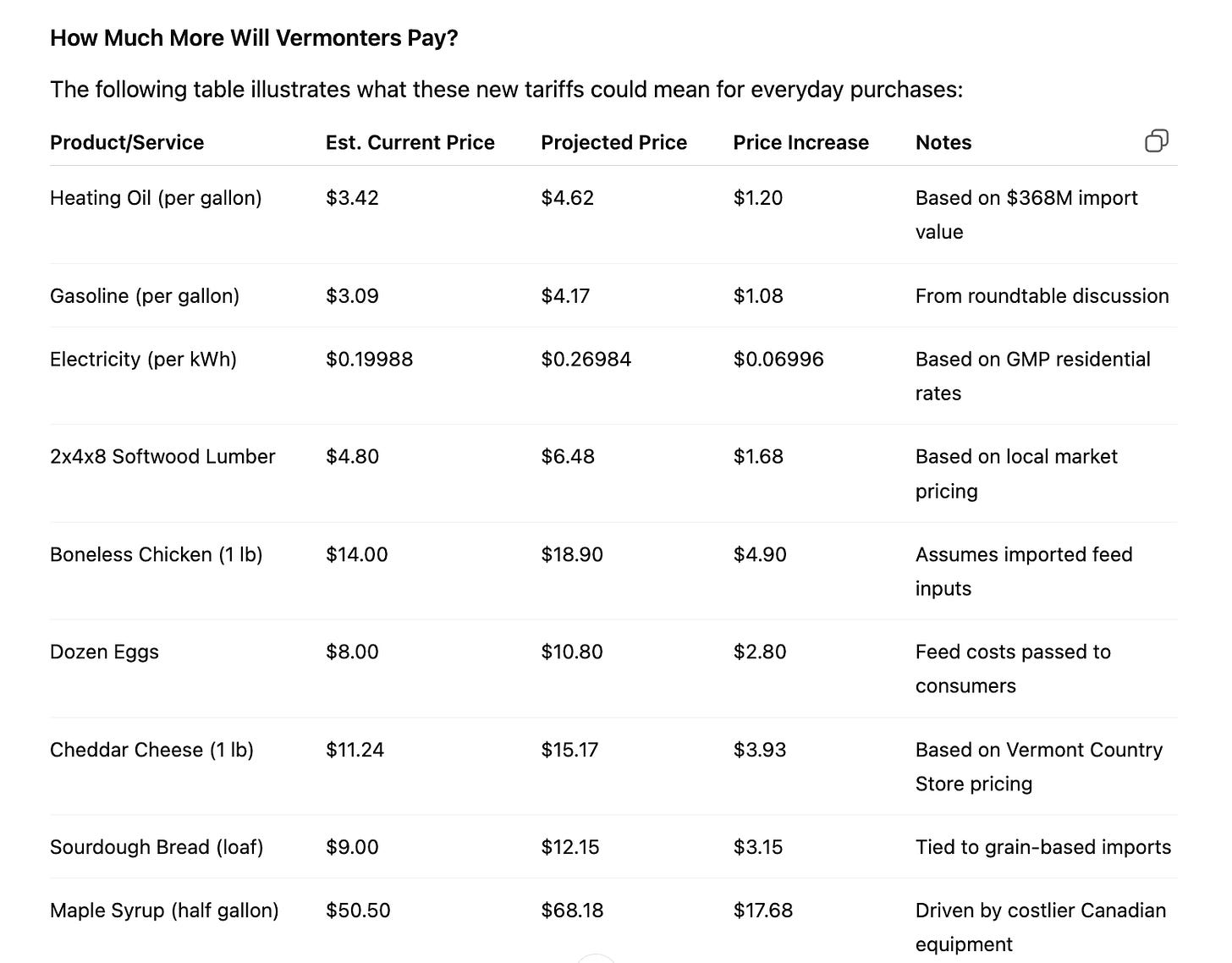

A 2x4's Price Going Up $1.68 - Plus More Hits for Vermonters from Canadian Tariffs

Vermonters will first feel the pinch in their heating bills, fuel costs, and electricity rates.

The New Economic Reality at the 45th Parallel

As of August 1, a 35% tariff on non-USMCA-compliant Canadian goods went into effect, reshaping Vermont’s economy in ways that will be felt immediately—from gas pumps to grocery aisles to hardware store shelves.

According to the Vermont Agency of Commerce and Community Development, Vermont imported $2.6 billion worth of goods from Canada in 2023, compared to just $680 million in exports. Three-quarters of those imports came from Quebec. One in four Vermont businesses relies on Canadian trade, and Canadian-owned companies employ thousands of Vermonters. By value, Vermont imports more goods from Canada than from its next nine largest foreign trading partners combined.

The new tariffs are part of what the White House has called a “reciprocal trade realignment,” but for Vermonters, they amount to an economic tremor shaking everyday life. The following breakdown shows where those shocks will hit first—and hardest.

A Volatile Policy Becomes Reality

The tariff was first introduced on April 2, 2025, as part of a sweeping trade realignment policy announced by President Trump, who referred to the date as “Liberation Day.” According to a review by the Congressional Research Service, the administration has modified its tariff policies 28 times since 2021, leading to widespread confusion among businesses operating across borders.

Initially set at 25%, the tariff on most Canadian goods was raised to 35% on August 1. The White House cited Canada’s “continued inaction” on issues such as fentanyl trafficking and what it called unfair trade practices.

In a public statement issued in late July, the Trump administration emphasized that further negotiations with Canada may not be forthcoming. “I think Canada could be one where there’s just a tariff, not really a negotiation,” the president said, according to Bloomberg News.

Energy Prices Lead the Surge

Vermonters will first feel the pinch in their heating bills, fuel costs, and electricity rates.

At a July business roundtable hosted by Senator Peter Welch, multiple participants noted that “almost all the gas and diesel home fuel comes from Canada.” According to the U.S. Census Bureau's trade data, Vermont imported $368 million in fuel oil from Canada in 2023. With the new tariff, the retail price of heating oil is projected to jump from $3.42 to $4.62 per gallon, assuming a full pass-through of the tariff to consumers.

Electricity is also heavily impacted. Green Mountain Power, Vermont’s largest utility, imports a significant portion of its electricity from Hydro-Québec. In a statement issued earlier this year, GMP President and CEO Mari McClure said that even a 25% tariff would be “passed straight to consumers.” With the rate now increased to 35%, GMP’s standard residential rate of $0.19988 per kilowatt hour is expected to rise to $0.26984.

Natural gas, which Vermont imports from Canada at a value of $145 million annually, will also see increased prices. These costs affect residential heating as well as commercial and industrial operations.

Higher Costs for Raw Materials and Construction

The construction sector is bracing for higher costs on key materials, especially Canadian softwood lumber. According to the U.S. International Trade Administration, Vermont imported $52 million in softwood lumber from Canada last year. A standard 2x4x8 board that previously sold for $4.80 is now expected to cost $6.48—an increase of $1.68.

Vermont Frames, a timber frame construction company, sources much of its lumber from Canada. Company representatives said the new tariffs could significantly raise project costs and delay timelines due to supply chain disruptions.

Agriculture is also feeling the strain. Poulin Grain, a major animal feed manufacturer based in Newport, sources between 30% and 40% of its feed ingredients—including corn, oats, canola, and molasses—from Canada. According to Mike Tetreault, general manager at Poulin, the company expects a $10 million increase in costs due to the tariff. He noted that these costs will be passed down to Vermont farmers, particularly in the dairy industry.

Paper and packaging manufacturers, which import $88 million in paper products and $28 million in semi-finished wood products annually, are also facing rising input costs, according to Vermont’s Department of Economic Development.

Vermont’s Signature Industries Under Pressure

Few sectors illustrate Vermont’s economic ties to Canada more than maple syrup.

According to producers and equipment suppliers, the majority of maple-specific production gear—such as evaporators, arches, tubing, and storage tanks—is manufactured in Canada. “Everything we own is from Canada,” said one fourth-generation sugarmaker in Addison County. “We wouldn’t be able to make maple syrup without Canada.” A 35% tariff on this equipment dramatically increases capital costs for both current producers and newcomers hoping to enter the market.

The issue doesn’t stop at equipment. Bulk Canadian syrup is regularly imported by U.S. distributors, who blend it with Vermont syrup to meet national retail demand. According to data from Agriculture and Agri-Food Canada, about 60% of Canadian maple exports go to the United States. Tariffs on this syrup will raise input costs for Vermont-based packers and distributors, and potentially increase prices for consumers.

Sticker Shock at the Grocery Store

Consumers will also see changes in the grocery store. Vermont’s largest non-energy import from Canada is cocoa and chocolate, valued at $475 million annually. These imports support major processors like Barry Callebaut, which operates facilities in the state. According to company representatives, a 35% tariff will increase the cost of both finished chocolate products and chocolate-based ingredients used in other food manufacturing.

Other grocery items likely to see price hikes include cereals, bread, coffee, and sugar. According to trade data from the U.S. Department of Agriculture:

Vermont imported $34 million in pasta, bread, and cereal products

$45 million in sugars and sugar products

$40 million in unprocessed cereals

$20 million in coffee, tea, and spices

Canadian Retaliation Puts Vermont Exports at Risk

Canada has responded with its own retaliatory tariffs, targeting U.S. goods—especially from politically sensitive sectors like agriculture. According to Canada’s Department of Finance, the retaliatory list includes milk, cream, yogurt, butter, and specific cheeses. For Vermont’s dairy producers, who exported $96 million worth of dairy goods to Canada in 2023, this poses a serious challenge.

“Farmers are facing it from both ends now,” said Poulin Grain’s Tetreault. “They’re paying more to feed their cows, and they may lose access to a major market.”

Canada’s countermeasures also threaten Vermont’s $150 million in total food and agricultural exports, which include maple syrup, specialty cocoa, and coffee products.

In addition, manufactured goods are vulnerable. Vermont exports $685 million in computer and electronic products—some of which are USMCA-compliant—but also $176 million in machinery, $125 million in paper, and $191 million in miscellaneous goods that may not qualify for protection.

Is There a Way Back?

No resolution appears imminent. According to reporting by The Washington Post, President Trump has tied any future deal to non-economic issues such as Canada’s stance on recognizing Palestinian statehood, further complicating negotiations.

Trade experts interviewed by Politico say the administration’s approach is highly transactional and unpredictable, meaning that while a negotiated settlement is possible, it’s unlikely to restore previous norms. Any truce would likely involve concessions on dairy or border security.

There is also a possibility that the courts will intervene. Several lawsuits challenging the use of the International Emergency Economic Powers Act (IEEPA) to impose tariffs have been filed, but any resolution could take years. In the meantime, the damage to Vermont’s economy could be lasting.

Conclusion: A Costly New Normal for Vermont

For Vermonters, the 35% tariff on Canadian imports is not a theoretical policy debate—it’s a shift in the cost of daily life. From electricity bills to maple production gear, the impacts are immediate and broad. At the same time, Canadian retaliation puts vital Vermont exports—including dairy and maple syrup—under threat.

The USMCA was designed to protect trade stability, but according to trade attorneys familiar with its enforcement, many of Vermont’s key imports fall outside its scope due to complex rules of origin. That leaves businesses exposed.

Absent a breakthrough in trade talks or a court ruling, the most likely outcome is a prolonged period of higher costs, economic uncertainty, and shrinking margins. For a state whose economic identity is deeply linked to its northern neighbor, the challenge is not only how to adapt—but how to endure.